Take the stress out of payroll, compliance, and reporting — all in one secure platform.

PaysOnline combines powerful automation with real Australian payroll specialists to help you process pay runs accurately, manage tax and super obligations, and stay compliant with ATO and Fair Work requirements.

Why Choose PaysOnline for Payroll & Compliance

100% Australian-owned and operated

ISO 27001 certified for data security

AFSL 540954 for financial transaction security

Real humans located in Australia on support — no bots

Built for Fair Work and ATO compliance

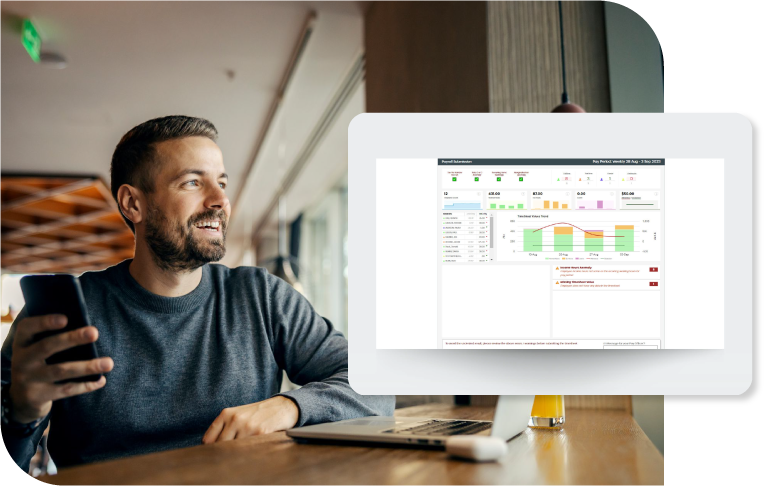

Payroll Processing

Accurate, compliant, and effortless payroll every time

Process employee wages on time and with total confidence. PaysOnline automates calculations, applies the right pay rules, and streamlines every approval step.

Key Features

Automated pay calculations – Handles super, PAYG, leave, and overtime with precision.

Award interpretation – Built-in rules to meet Fair Work obligations automatically.

Multi-frequency pay runs – Weekly, fortnightly, or monthly.

Approval workflows – Review and verify before submission.

Dedicated payroll specialist – Real humans available to help when you need them.

Accurate payments – Generate ABA files or use full-service payment processing via our trusted banking partner.

Tax & Super

Stay compliant with every contribution and lodgement

PaysOnline simplifies your tax and super management so you can meet every reporting and payment deadline effortlessly.

Key Features

SuperStream-compliant payments – Secure, automated super contributions to multiple funds.

Payday Super ready – Aligned with the latest ATO requirements for 7day payment compliance.

PAYG withholding – Automated calculations and ATOready reports.

Payroll tax management – Generate, review, and lodge returns per state.

Single payment processing – Consolidate super and tax remittances into one transaction.

Audit trail – Full visibility and exportable logs for your records.

“PaysOnline made the payroll so simple. Our fortnight pay cycle is so much faster and easier to work. The PaysOnline team is also very helpful and friendly to work with when support is needed.”

— Anon Ngamphattharaworakul

Haulotte Australia

Compliance Tools

Automated compliance that protects your business

Reduce your exposure to risk and stay auditready with PaysOnline’s builtin compliance monitoring.

Key Features

Award & pay rule automation – Apply correct pay rates, penalties, and entitlements automatically.

Document expiry reminders – Never miss a certification or license renewal.

Risk alerts & dashboards – Detect potential breaches before they occur.

Change history logs – Full audit visibility of pay and role changes.

Fair Work & ATO compliance – Always current with legislative updates.

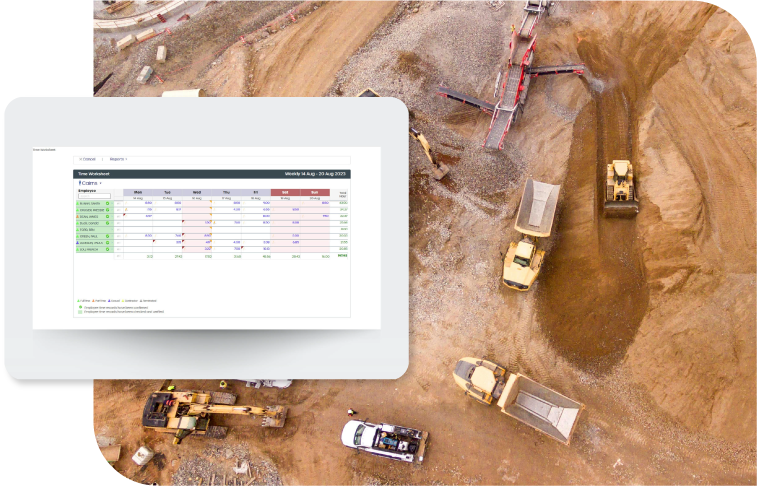

STP & ATO Integration

Simplify reporting and stay aligned with ATO standards

PaysOnline’s seamless Single Touch Payroll (STP Phase 2) integration ensures that your employee and payment data reaches the ATO accurately and on time.

Key Features

STP Phase 2 compliant – Fully approved and aligned with current ATO requirements.

Automated submissions – No manual uploads or rekeying.

ATO data validation – Minimise reporting errors before lodgement.

Yearend processing – Streamline income statements and EOFY reports.

“I first took over payroll 2 years ago from our previous paymaster. With no training, I could not have asked for a better Team, who could not do enought to help me learn the system. At all times, no matter what questions I had, the Team helped me through it. The pleasure has been mine to work with you all, keep up the great work.

— Joe Prestipino

B&D Insulation Contracting

Request a Demo

Find the plan that fits your business size and complexity — from streamlined payroll to full HR and compliance management.

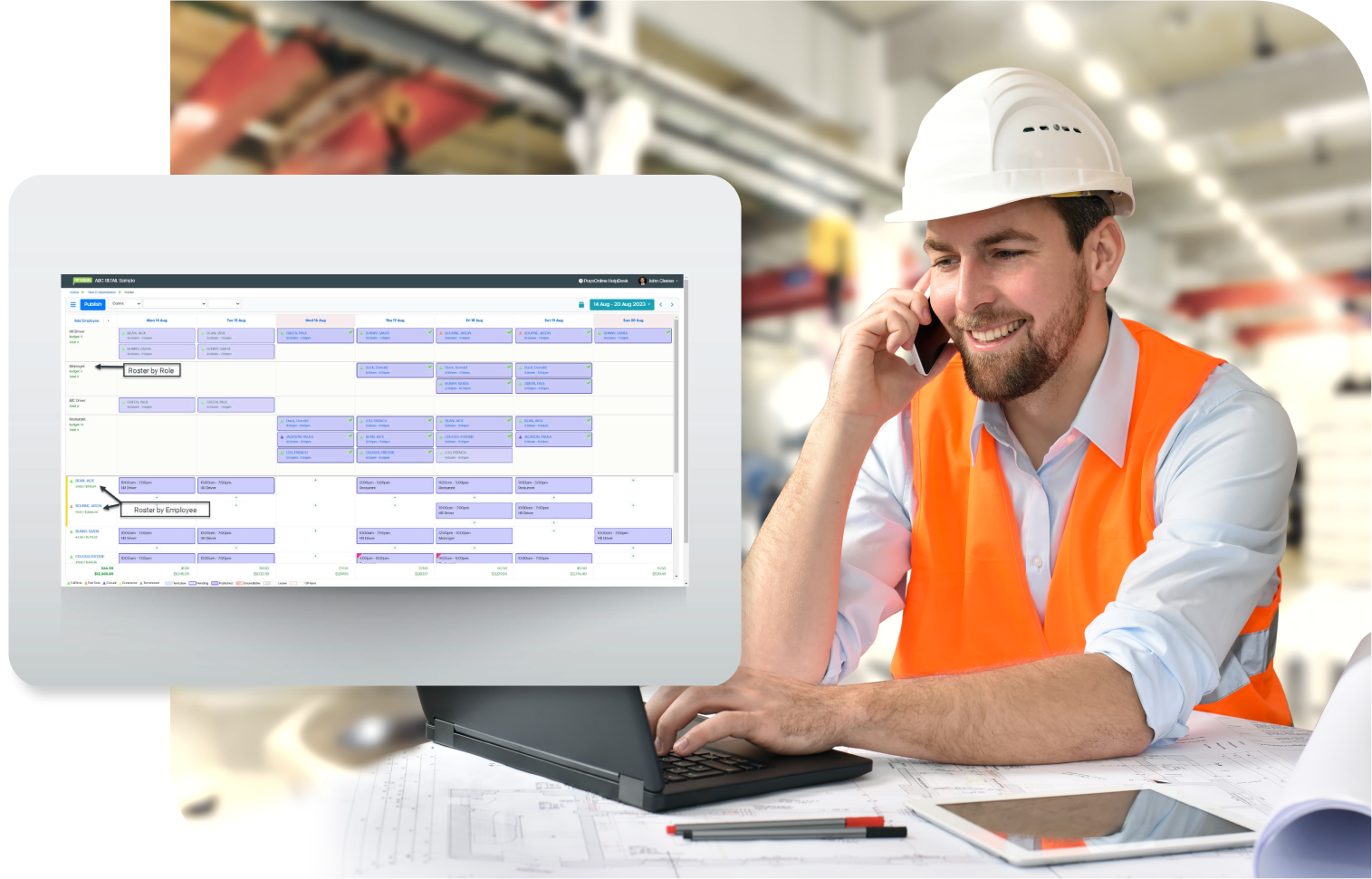

Need More Than Payroll?

Explore other solutions designed to simplify workforce management:

Get Started Today

Ready to run payroll the smart way?

Request a demo to see how PaysOnline helps Australian businesses process payroll accurately, stay compliant, and focus on what matters most — their people.