Your complete Payroll & HR Department

PaysOnline takes the complexity out of paying your people, managing your team, and staying compliant — all backed by local experts who know Australian business inside and out.

Since 1995, we’ve helped thousands of organisations streamline payroll, HR, and workforce compliance in one secure, easy-to-use platform.

Quick Facts

Trusted by Australian businesses

ISO 27001 certified

STP Phase 2 & award interpretation

Real humans located in Australia on support — no bots

Who We Help

Business Owners

Simplify payroll, HR and compliance with one system that handles the heavy lifting — and support that speaks your language and is located in Australia.

Accountant and Bookkeepers

Add payroll and compliance to your services — with none of the hassle. We’ve got your back.

What Can PaysOnline Do For Your Business?

Run Payroll with Confidence

Automate pay runs, apply the right awards, and get expert help when you need it.

Stay Fully Compliant

We stay across Fair Work, ATO updates, and payroll legislation so you don’t have to.

Track Time Accurately

Capture attendance through mobile apps, web clocks or biometric terminals — fully synced with payroll.

Simplify Staff Management

Keep all employee records, pay changes, and role updates in one place — no more spreadsheets.

Onboard New Hires Easily

Create and send contracts, licences, and renewal reminders digitally.

Empower Your Team

Employees can view payslips, request leave, and update their details using their own login.

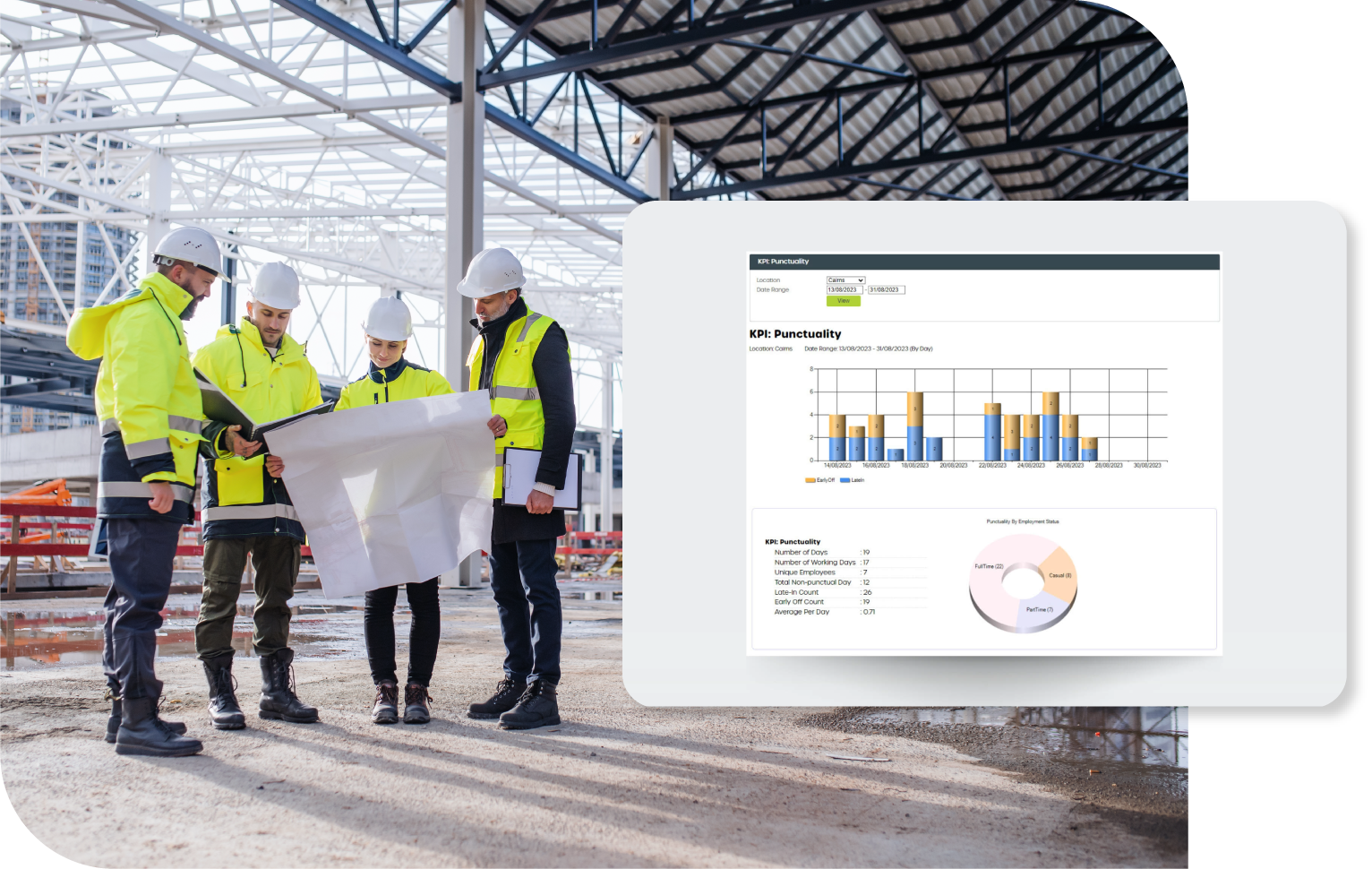

See What’s Going On

Access over 250 real-time reports across payroll, leave, compliance and tax via an easy-to-navigate dashboard.

“I first took over payroll 2 years ago from our previous paymaster. With no training, I could not have asked for a better Team, who could not do enough to help me learn the system. At all times, no matter what questions I had, the Team helped me through it. The pleasure has been mine to work with you all, keep up the great work.”

Why Australian Businesses Trust PaysOnline

— Joe Prestipin, B&D Insulation Contracting

Built for Australian business from day one:

In operation since 1995

Australian owned and operated

Australian onboarding, training & support via online support and phone calls

Fair Work Compliant

Get PaysOnline Today

Full-service Payroll & HR support

PaysOnline gives you everything you need to manage payroll, stay compliant, and support your team — all in one platform, backed by real Australian specialists.

Automate payroll and award interpretation

Stay compliant with Fair Work and ATO rules

Track time with mobile, web, or biometric tools

Manage HR, onboarding, and employee records

Get help from your own dedicated payroll expert