FAIR WORK COMPLIANCE CENTRE – NOV 2024

FAIR WORK GUIDANCE

Rules and entitlements during the end-of-year holiday season Rules and entitlements during the end-of-year holiday season – Fair Work Ombudsman

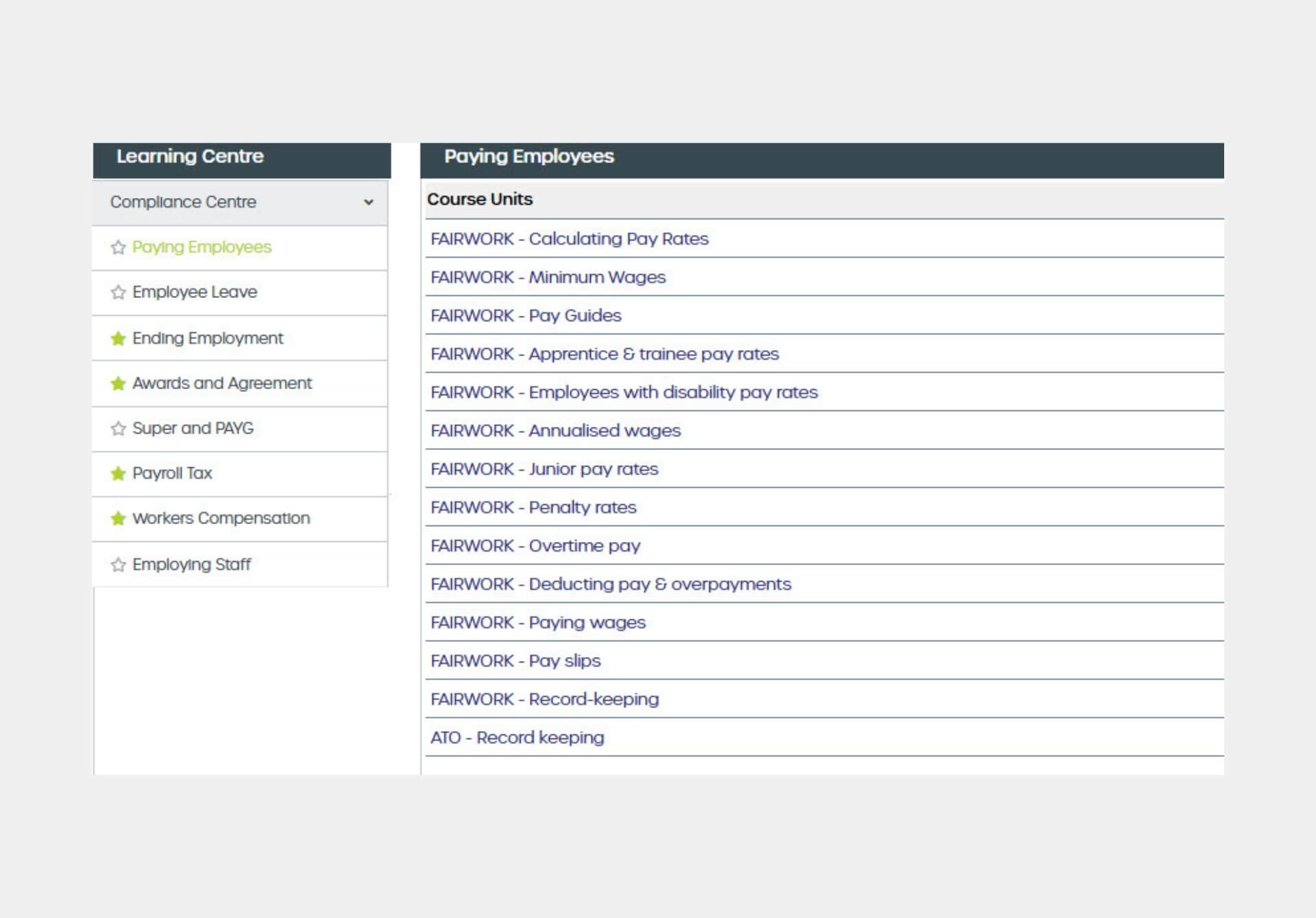

PAYSONLINE COMPLIANCE CENTRE

The PaysOnline Compliance Centre provides clients with access to a library of external links to the Australian Tax Office (ATO), Fair Work Australia, the Office of State Revenue (OSR), and more.

We understand that navigating these sites can be overwhelming and difficult, so we have done the hard work for you.

Items that can be found in the Compliance Centre are:

- Paying Employee

- Employee Leave

- Super and PAYG

- Employing staff

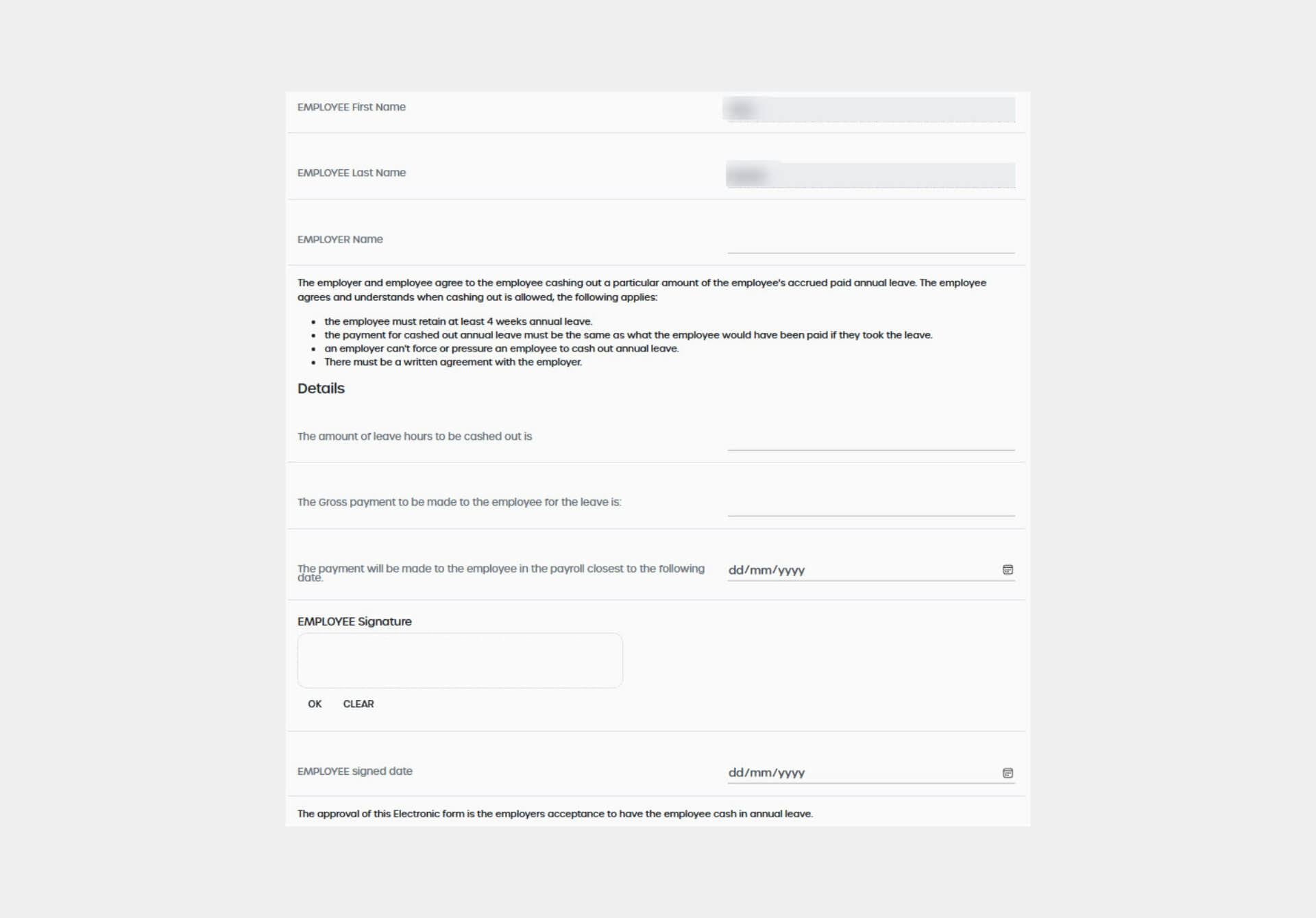

HR SMARTFORMS

PaysOnline HR SmartForms will allow you to have paper documents sent electronically to your staff.

Under Fair Work guidelines, a lot of standard employee payroll requests need to be documented. FairWork provides templates that PaysOnline have built into our platform.

https://www.fairwork.gov.au/tools-and-resources/templates

This documentation is required for, but not limited to:

- Cashing in Annual Leave

- Payroll deductions (including overpayment, uniforms, credit card use)

- Casual Conversion

- Employment Contracts

- Salary Sacrifice requests

The HR SmartForms can be set up on clients’ accounts for employees to submit the requests electronically. This eliminates the need for emails or paper documents that could pose a security/privacy risk.

HR SmartForms are available on our Enterprise+ plan.