News and Updates

February 2025

FAIR WORK CHANGES – FEB 2025

Nurses Award

- Nursing assistants from the first full pay period starting on or after 1 January 2025, and

- Registered and enrolled nurses from the first full pay period starting on or after 1 March 2025.

Nursing assistants

Registered nurses

- annual progression through pay points for levels 1, 2 and 3

- grades for levels 4 and 5.

Enrolled Nurses

Translation arrangements

January 2025

Payday Super and Casual Conversion – JAN 2025

Payday superannuation

Here’s what we know so far:

- From 1 July 2026, an employer will be required to make SG contributions on ‘payday’. Payday is the date that an employer makes an Ordinary Time Earnings (OTE) payment to an employee.

- Payday Super each time OTE is paid, there will be a new 7-day ‘due date’ for contributions to arrive in the employees’ superannuation fund. This provides time for the movement of funds through the payment system, including clearing houses.

- An employer will be liable for the new SG charge unless SG contributions are received by their employees’ superannuation fund within 7 calendar days of payday.

- There will be some limited exceptions:

- Contributions for OTE paid within the first two weeks of employment for a new employee will have their due date deferred until after the first two weeks of employment.

- Small and irregular payments that occur outside the employee’s ordinary pay cycle would not be considered a payday until the next regular OTE payment or ‘payday’ occurs.

- Employers will need to pay SG contributions on payday, so they are received in an employee’s super account within 7 calendar days of payday.

- If funds are not received in an employee’s superannuation account within 7 days, the employer will be liable to pay the SG charge, even ahead of the ATO issuing an assessment.

- An employer in this situation should make contributions to their employee’s superannuation fund as soon as possible. This will minimise their liability and penalties.

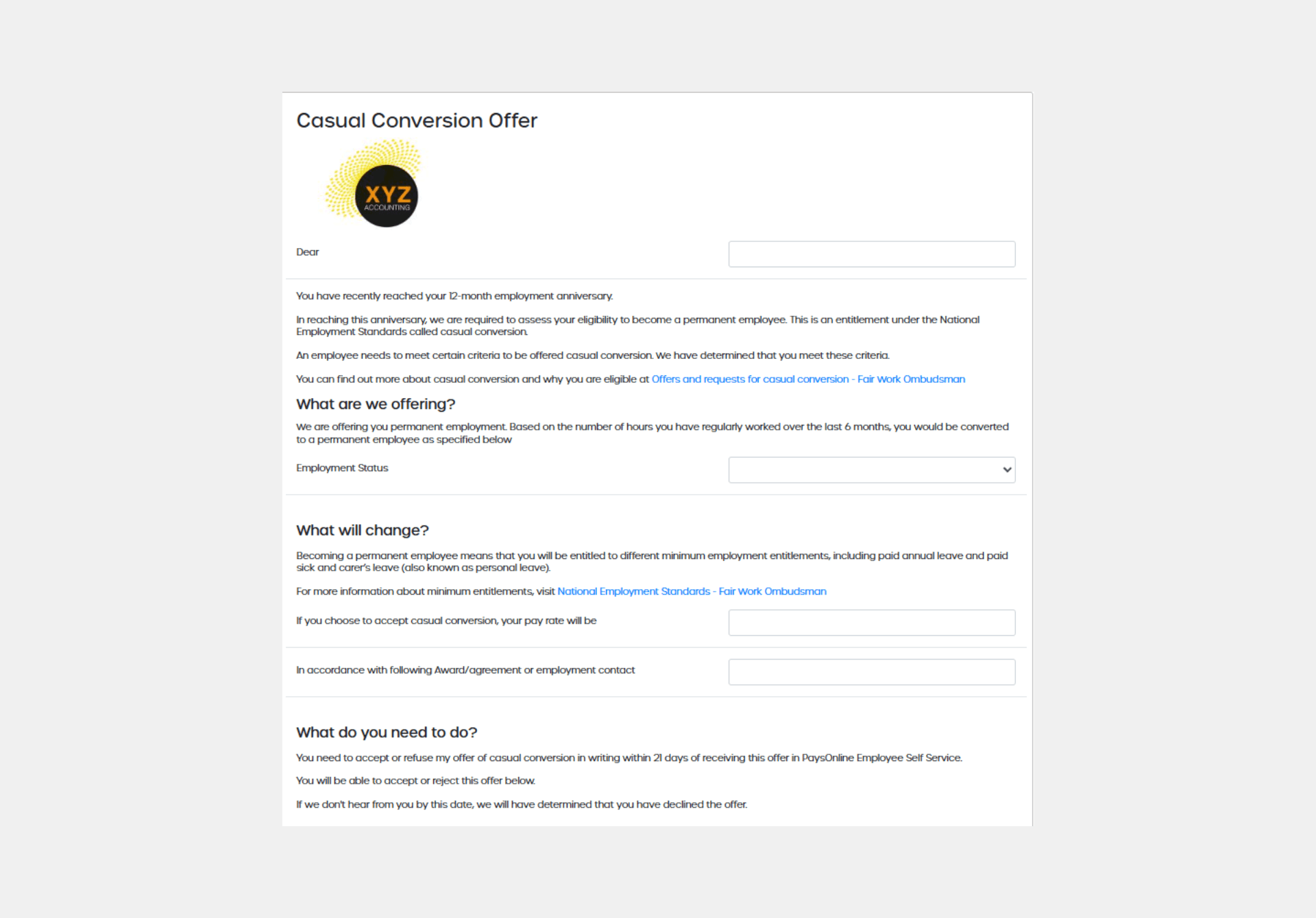

Casual Conversion – Do you know your obligations?

- they were employed before 26 August 2024

- they’ve completed at least 12 months of work with their employer and meet certain criteria, and

- their employer does not have reasonable grounds to not convert them.

- Was you casual employee employed before 26 August 2024? – If no, then no action is required

- Your business has 15 or more employees – (if you have fewer than 15 employees you are not required to offer casual conversion)

- Has the employee been working with you for at least 12 months? – If YES, within 21 days of their 12-month anniversary, you must assess whether they are eligible and either offer them a conversion in writing or explain in writing why you are not offering conversion.

- Has the employee worked a regular pattern of hours on an ongoing basis for at least 6 months of their first 12 months of employment?

- Establish if the employee could continue working this regular pattern of hours as a permanent employee without significant changes – Significant changes could include that the employee’s hours of work would need to be significantly increased or decreased for them to become a permanent employee (for example to meet applicable award requirements).

- There are no reasonable grounds to refuse to offer permanent employment to the employee- If you answered No to one of the above questions you don’t have to offer casual to your employees, but if you said yes to question 1,2 and 3 you MUST tell them in writing and include the reason why. If you answered YES to all questions, you MUST offer your employee casual conversion.

- Notify your employee of your decision in writing.

- If you offer casual Conversion, the employee must respond within 21 days The employee must respond in writing within 21 days after the offer is given to them, stating whether they accept or decline the offer. If they accept, you need to meet with them If they decline your offer of casual conversion, you don’t need to meet with them. If they don’t respond to your offer within 21 days, you can assume they’ve declined the offer.

- If your employee accepts the offer, you must meet with them to discuss their new conditions of employment, including:

• whether they are converting to full-time or part-time employment

• their hours of work as a permanent employee

• their start date as a permanent employee.

You must then give them written notice of those details within 21 days of the employee accepting the offer to convert.

December 2024

FAIR WORK CHANGES – DEC 2024

Fair Work – New criminal underpayment Laws

From 01 January 2025, intentionally underpaying an employee’s wages or entitlements can be a criminal offence. This doesn’t include honest mistakes.

What’s changing

FairWork can investigate suspected criminal underpayment offences and refer suitable matters for criminal prosecution. If a person is convicted of a criminal offence, a court can impose fines, prison time, or both.

Code and Guide

FairWork can’t refer a small business employer’s conduct for possible criminal prosecution if they are satisfied that they’ve complied with the Code in relation to an underpayment.

A small business employer will comply with the Code if they don’t intend to underpay their employees. This will be assessed by looking at several factors. These factors aren’t new to compliant employers. Instead, they’re steps many already take as part of good business practice.

Guide to help you understand the Code

Our Guide to Paying Employees Correctly and the Voluntary Small Business Wage Compliance Code can help businesses understand the Code. It offers practical advice and tools, including a handy checklist, examples, and best practice tips.

The PaysOnline Modern Award Rate validation tool assists clients in ensuring employees are on the correct rate for their award and level.

Fair Work – Changes to entry-level Classifications

- introductory classifications can only apply for a limited time

- new rules and minimum pay apply for introductory rates.

- 1 January 2025 for most awards

- 1 April 2025 for the Horticulture Award and Pastoral Award.

- an initial induction period

- time spent undertaking training, or

- enough time to gain basic skills and experience required for the job.

Quick Onboarding – Flexibility for Mandatory requirements

- Employment Contracts acceptance

- Copies of Licences

- Proof of Qualification

- Next of Kin details

November 2024

FAIR WORK COMPLIANCE CENTRE – NOV 2024

FAIR WORK GUIDANCE

Rules and entitlements during the end-of-year holiday season Rules and entitlements during the end-of-year holiday season – Fair Work Ombudsman

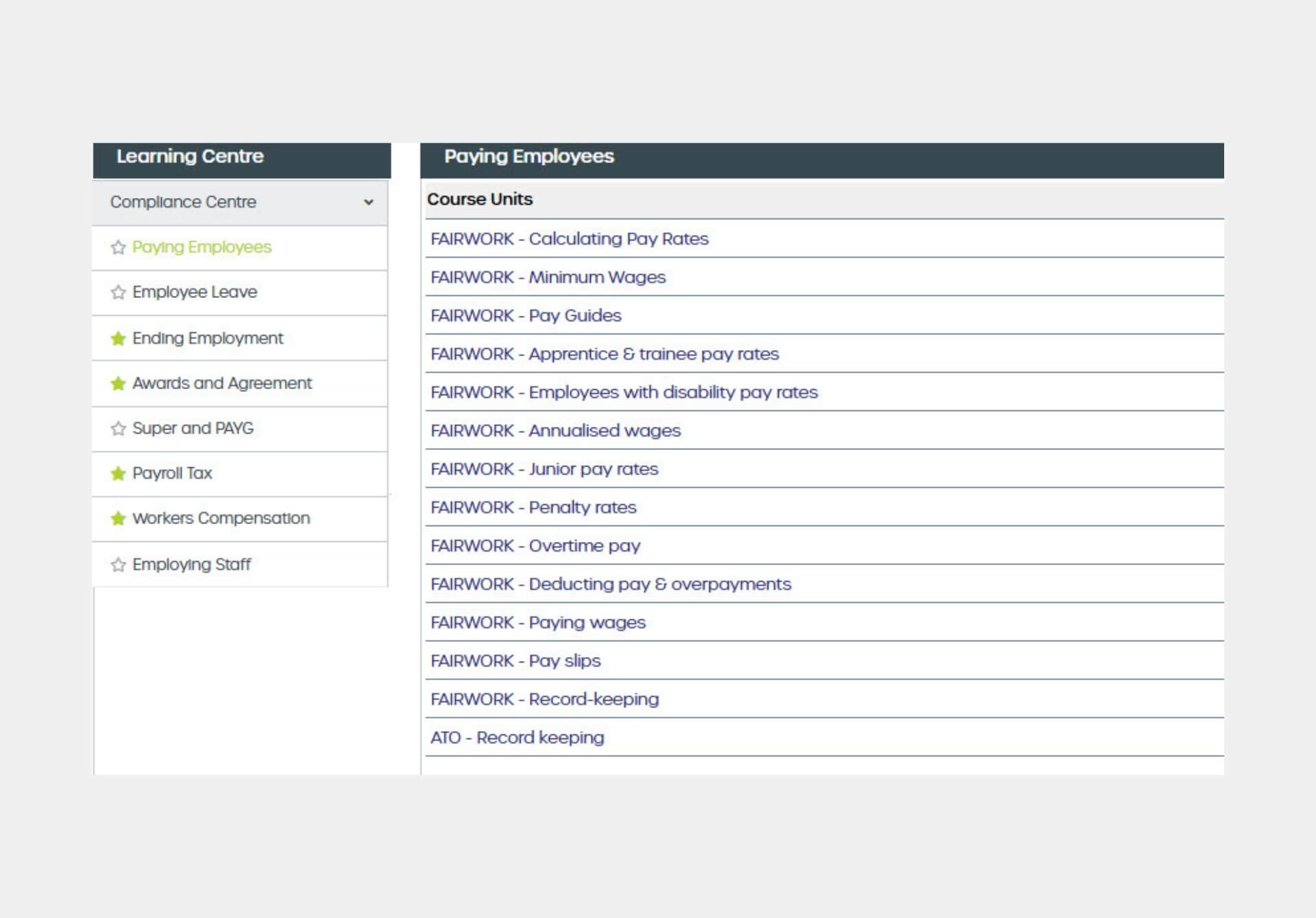

PAYSONLINE COMPLIANCE CENTRE

The PaysOnline Compliance Centre provides clients with access to a library of external links to the Australian Tax Office (ATO), Fair Work Australia, the Office of State Revenue (OSR), and more.

We understand that navigating these sites can be overwhelming and difficult, so we have done the hard work for you.

Items that can be found in the Compliance Centre are:

- Paying Employee

- Employee Leave

- Super and PAYG

- Employing staff

HR SMARTFORMS

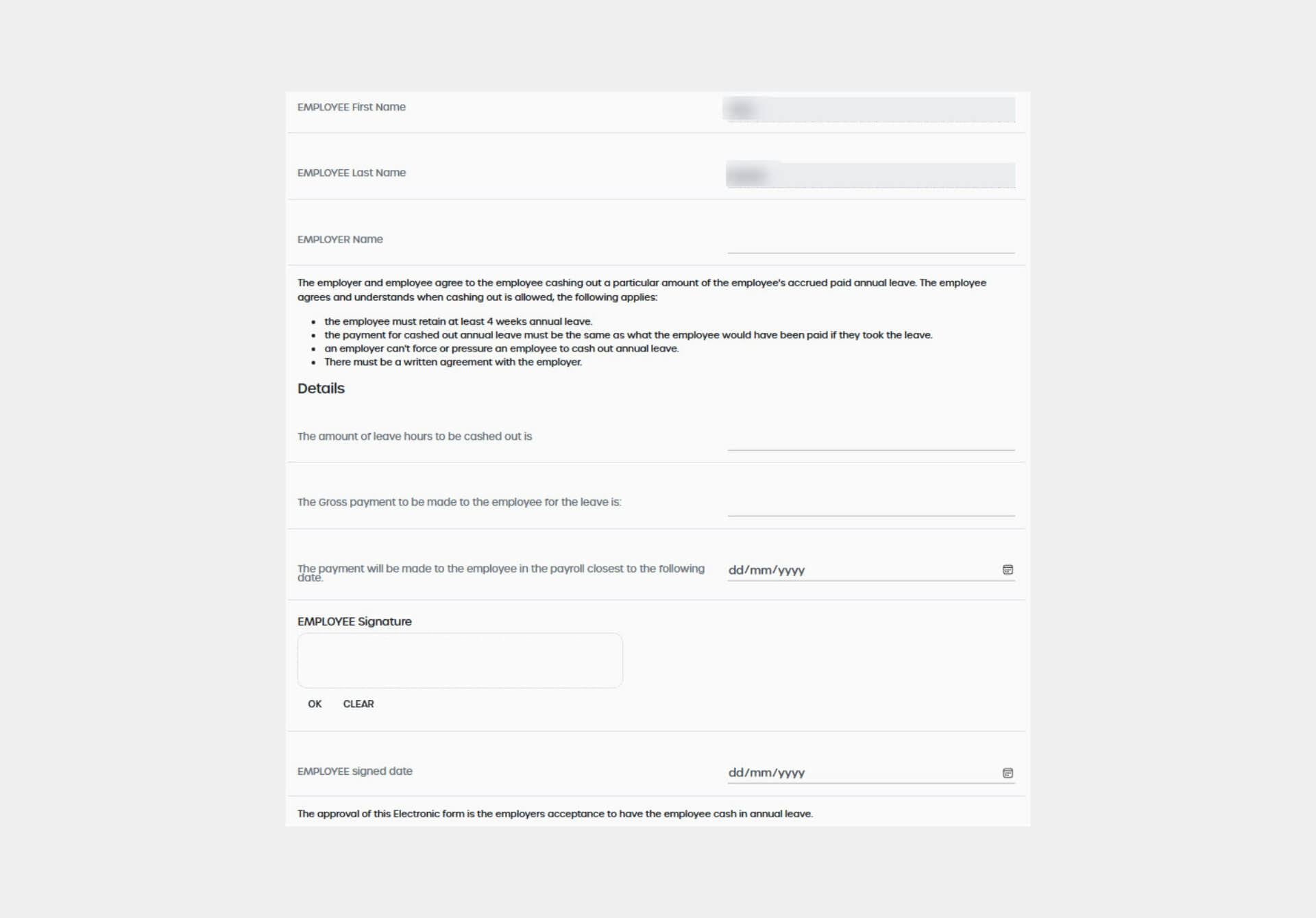

PaysOnline HR SmartForms will allow you to have paper documents sent electronically to your staff.

Under Fair Work guidelines, a lot of standard employee payroll requests need to be documented. FairWork provides templates that PaysOnline have built into our platform.

https://www.fairwork.gov.au/tools-and-resources/templates

This documentation is required for, but not limited to:

- Cashing in Annual Leave

- Payroll deductions (including overpayment, uniforms, credit card use)

- Casual Conversion

- Employment Contracts

- Salary Sacrifice requests

The HR SmartForms can be set up on clients’ accounts for employees to submit the requests electronically. This eliminates the need for emails or paper documents that could pose a security/privacy risk.

HR SmartForms are available on our Enterprise+ plan.

October 2024

PAYROLL CENTRE – OCT 2024

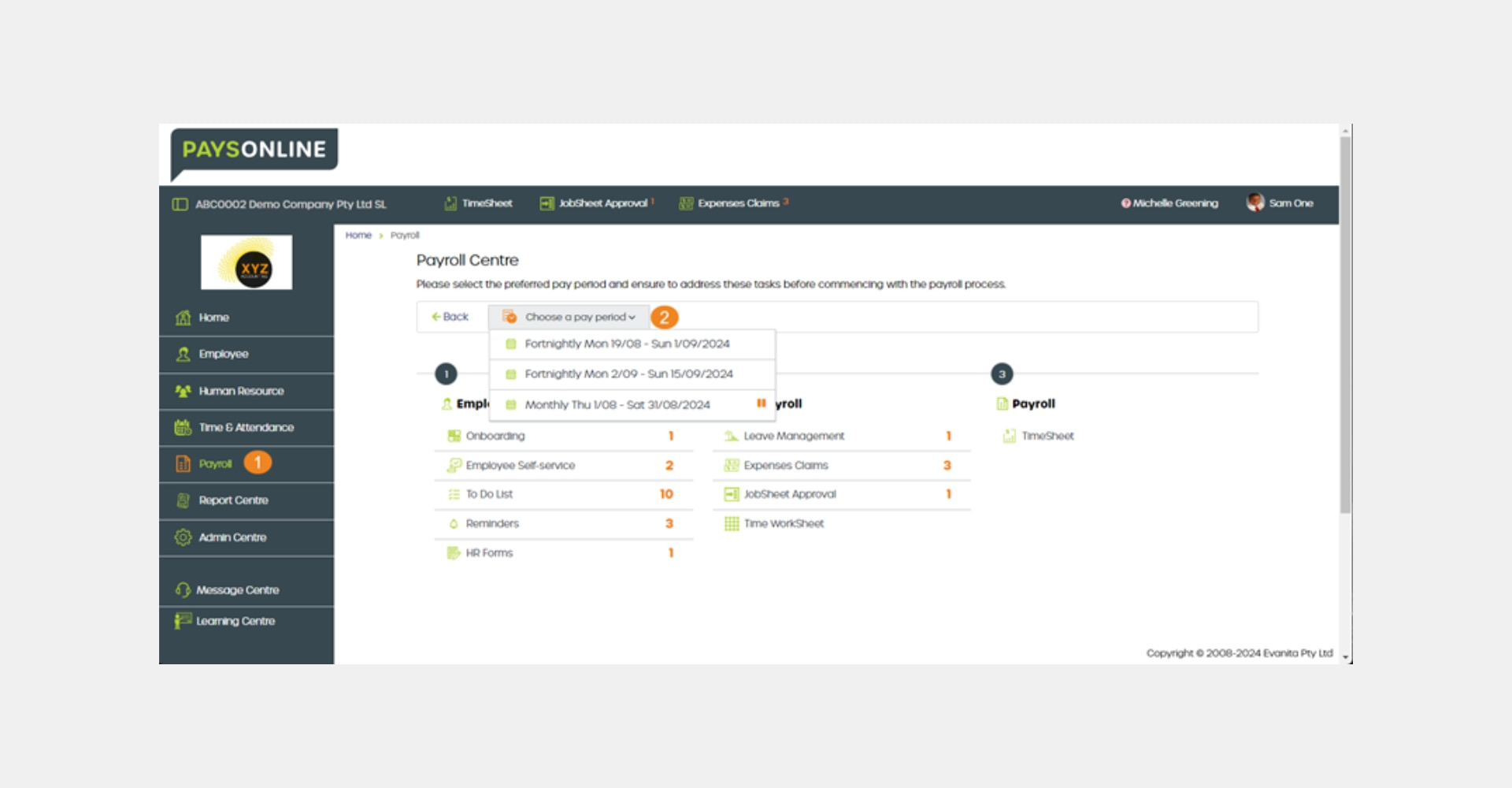

PAYROLL CENTRE

We’ve updated the Payroll Centre to help you complete all payroll steps. Follow the details set out in your Payroll Centre to ensure you are not missing any important data.

If any data needs review, approval, or finalisation, you’ll see a number next to each relevant item.

TIMESHEET CHANGES

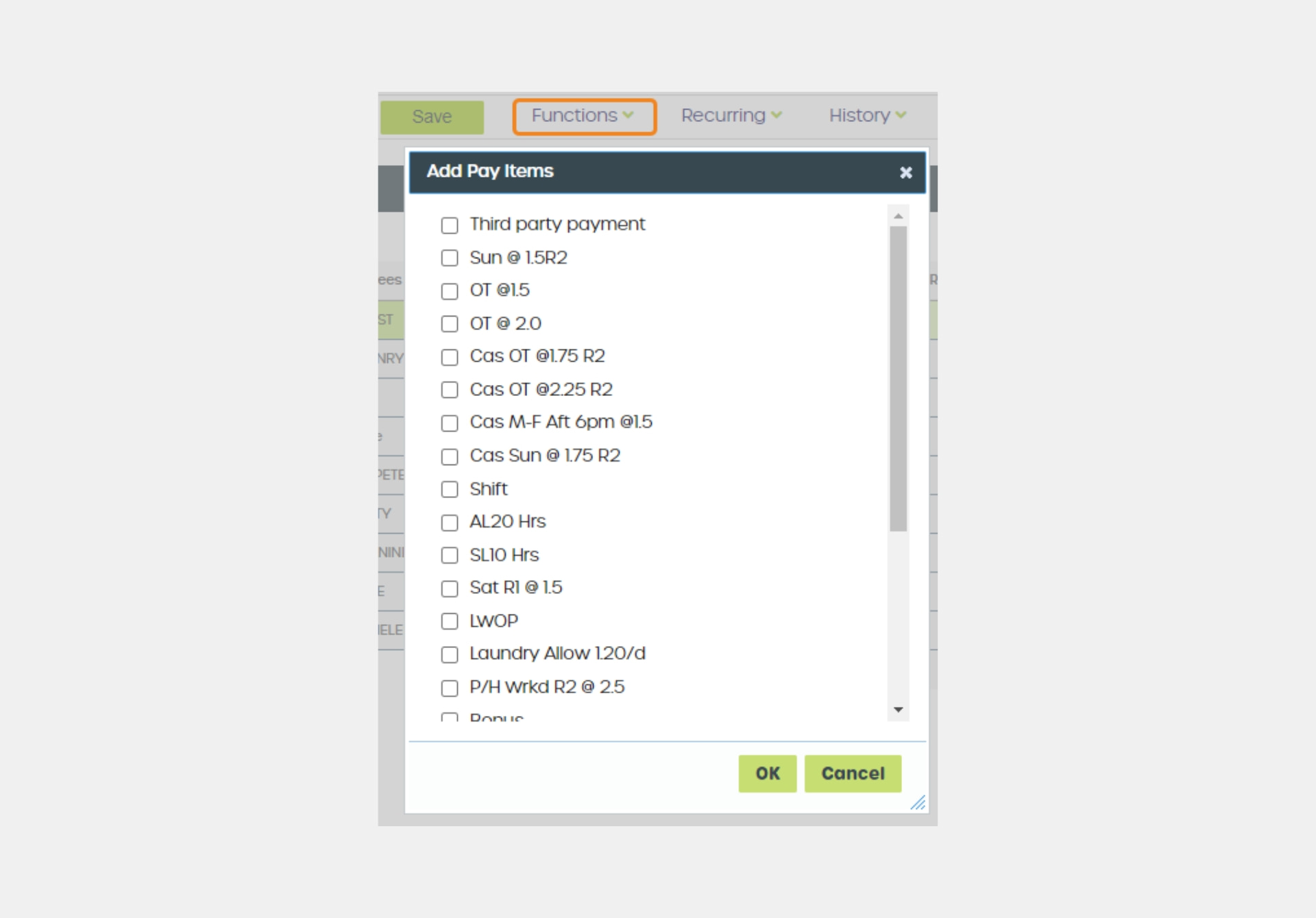

Items that are not used regularly have been hidden to assist with managing your payroll data.

If you are using leave management or time and attendance, required pay items (e.g. leave) will load when you import the data.

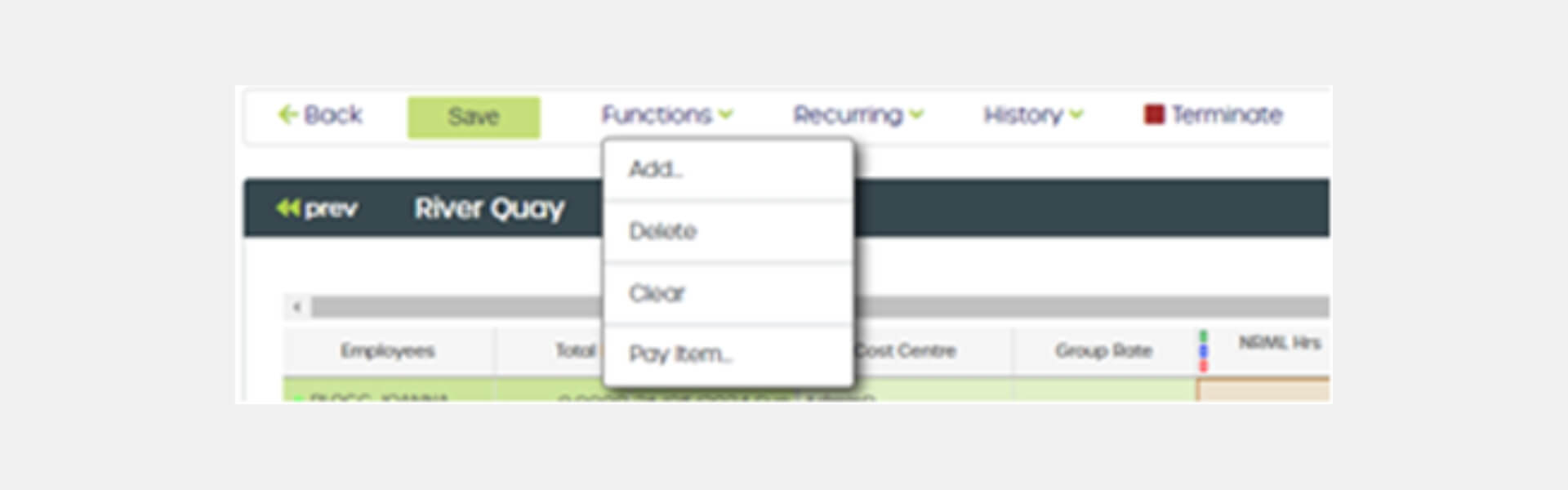

If you are not utilising all features and employee are not applying for leave via the system you can add the pay item manually.

September 2024

NEW / AMENDED REPORTS – SEPT 2024

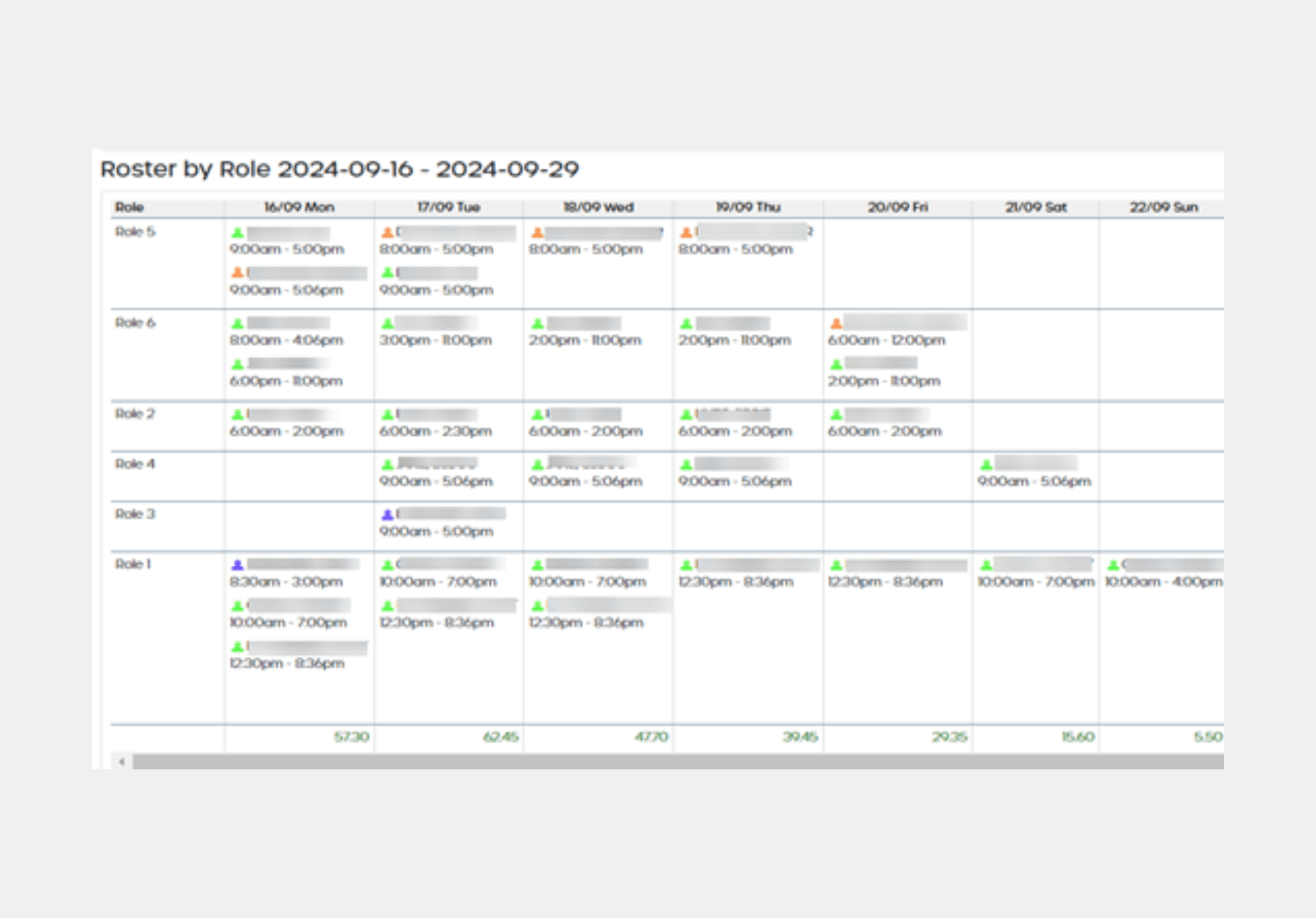

ROSTER BY ROLE

We have introduced a new report for easy viewing to ensure the correct people are rostered together when using roles for rostering. Data can be printed (for up to 14 days) or downloaded into Excel.

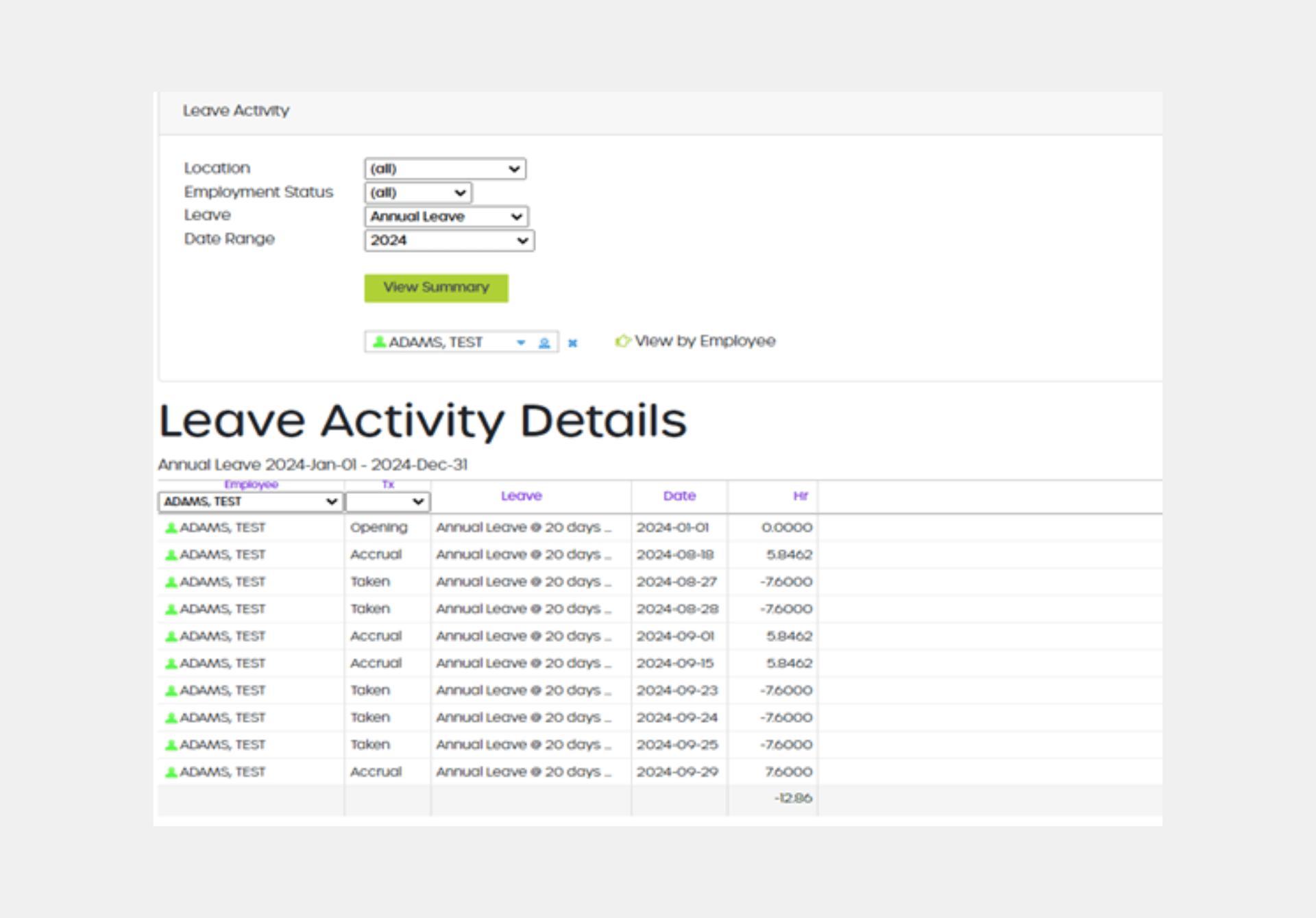

LEAVE ACTIVITY REPORT

Individual employee information can now be downloaded.

ADMIN CENTRE

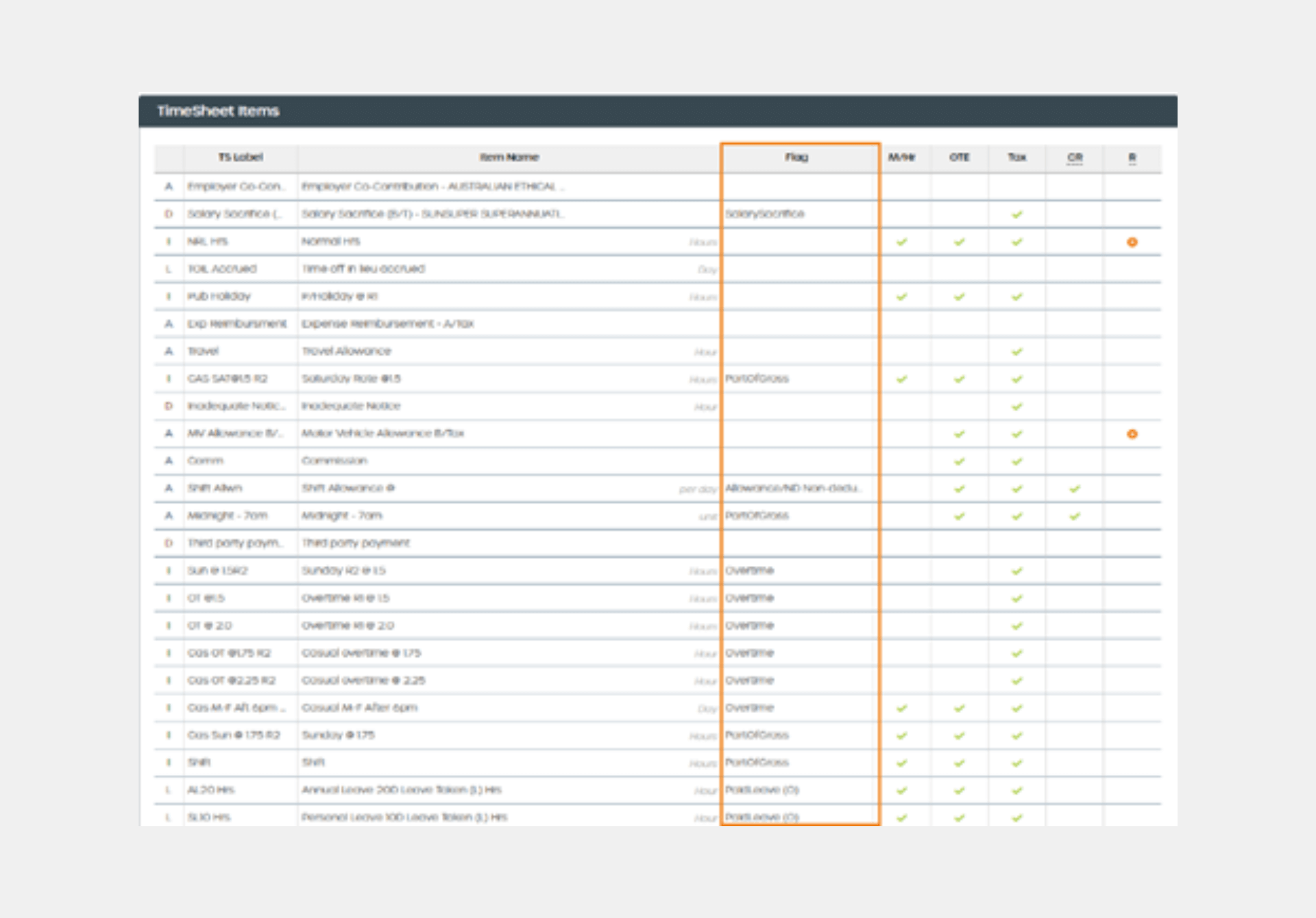

Time Sheet Items

In line with the changes to STP reporting, the Timesheet Items data will now display a flag on how information is reported to the ATO. This information will assist in STP in reconciling your STP data.

August 2024

NEW USER INTERFACE – AUG 2024

NEW USER INTERFACE

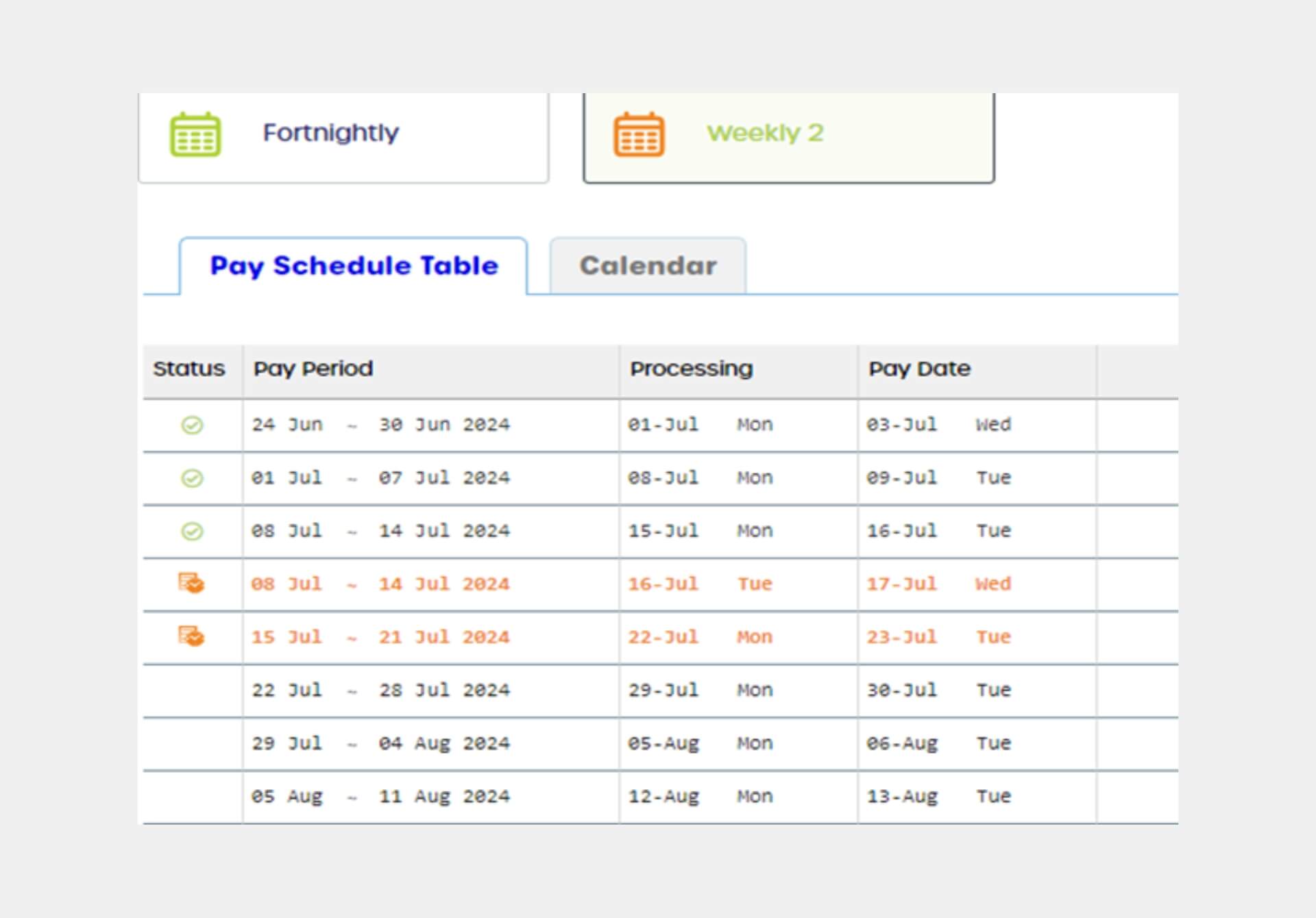

Pay Schedule

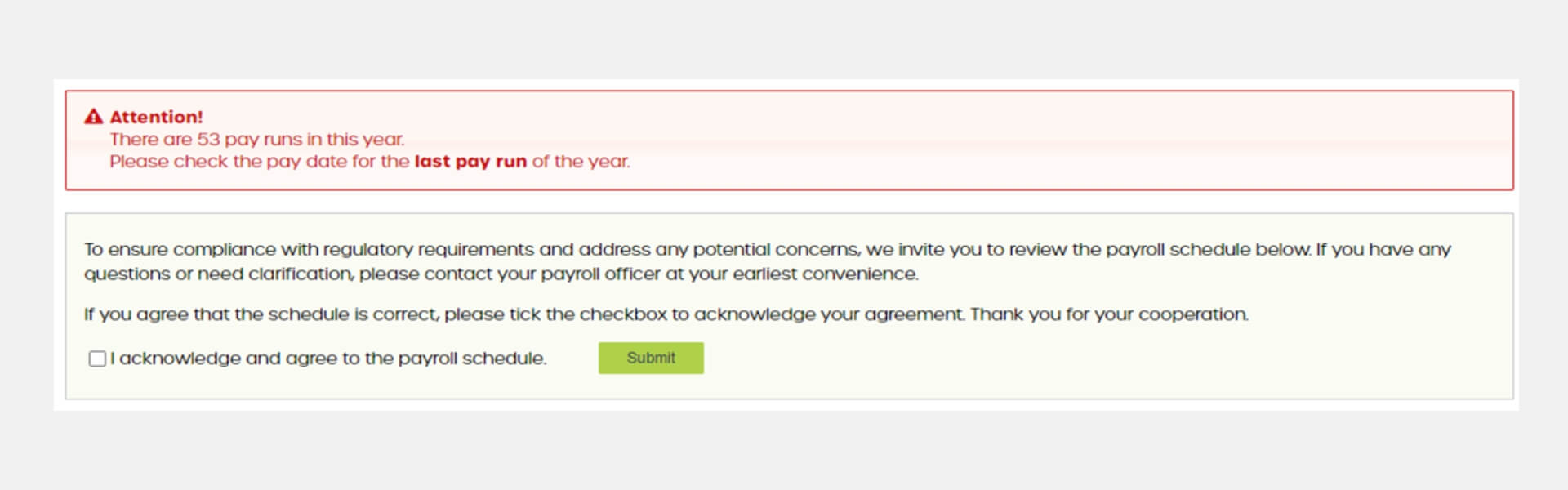

The Pay Schedule has been updated in line with the new branding. Changes include:

- Change lay out to display pay schedule table

- User acknowledgment for schedules where a client has 27 fortnights or 53 weeks.

FAIRWORK CHANGES

Closing the Loopholes – Changes to workplace laws to commence August 26.

Multiple changes have been made to casual employment laws. These include how casual work is defined, the pathway to full-time or part-time employment, and employee and employer responsibilities.

For full details from Fair Work Australia click here Casual employment changes – Fair Work Ombudsman

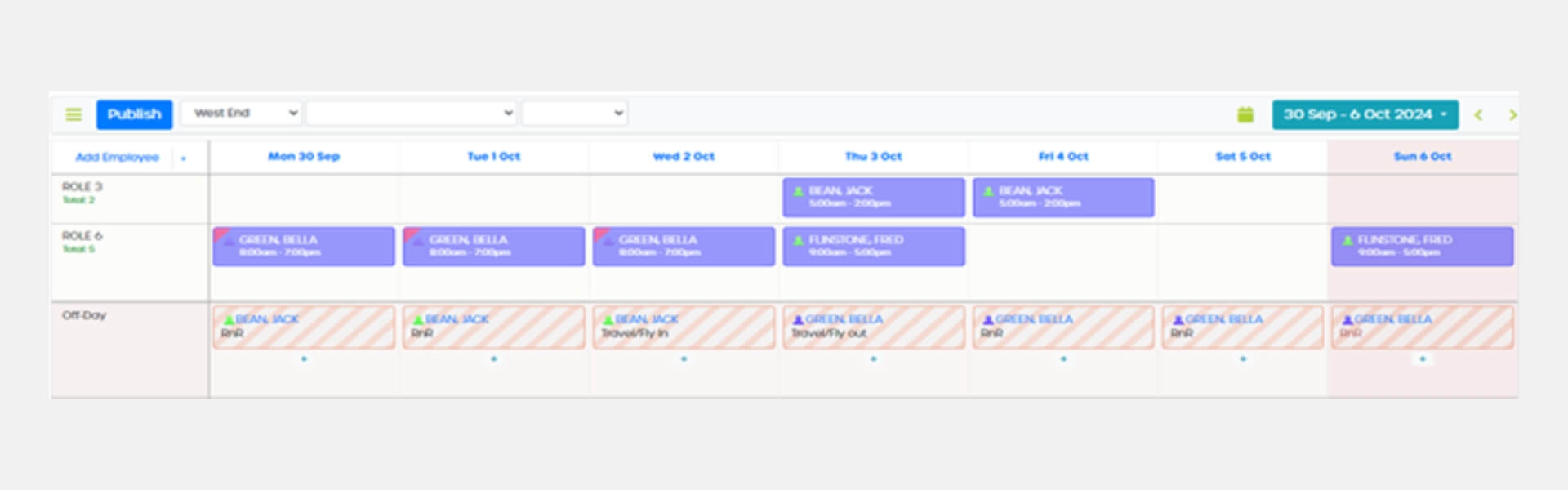

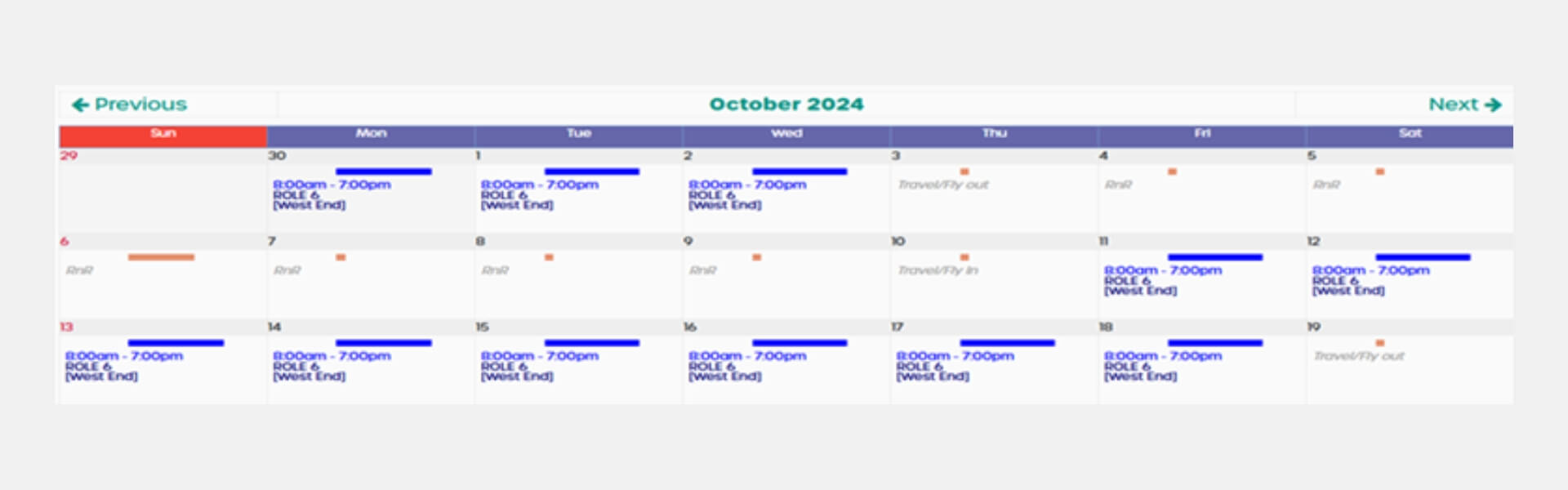

ROSTER

The Off-Day Item Banner has been added to allow you to view staff’s actions when they are not rostered on.

The feature is designed to benefit businesses with Fly In/Fly Out, so they know exactly what is occurring with their rosters.

July 2024

FAIRWORK – JUL 2024

FAIRWORK

Minimum wage increases from 1 July – Fair Work Ombudsman

The Fair Work Ombudsman is reminding employers that a 3.75 per cent minimum wage increase be applied to eligible employees’ pay from the first full pay period starting on or after 1 July 2024.

The new National Minimum Wage is $915.90 per week (based on a 38-hour week for a full-time employee), or $24.10 per hour. The rates have increased from $882.80 per week and $23.23 per hour. Casual employees entitled to the National Minimum Wage must receive a minimum $30.13 per hour, which includes 25 per cent casual loading.

The National Minimum Wage is the base rate for adult employees in the national system who are not covered by an award or registered agreement.

SERVICES AUSTRALIA

Paid Parental leave Payments

From 01 July 2024, the paid parental leave payment will increase to $183.16 a day before tax or $915.80 per 5-day week. This is based on the weekly rate of the national minimum wage.

PAYROLL TIMESHEET

Hiding Pay Items Not Used Regularly

This feature hides Pay items that are not used regularly on the timesheet. It ensures a quicker loading experience which is especially beneficial if you have many different pay items on your account.

Once enabled, additional pay items required for the payroll can be added seamlessly for that pay run while processing the timesheet.

Items such as leave, time and attendance details and standard payments will load automatically.

NEW / AMENDED REPORTS

STP Report

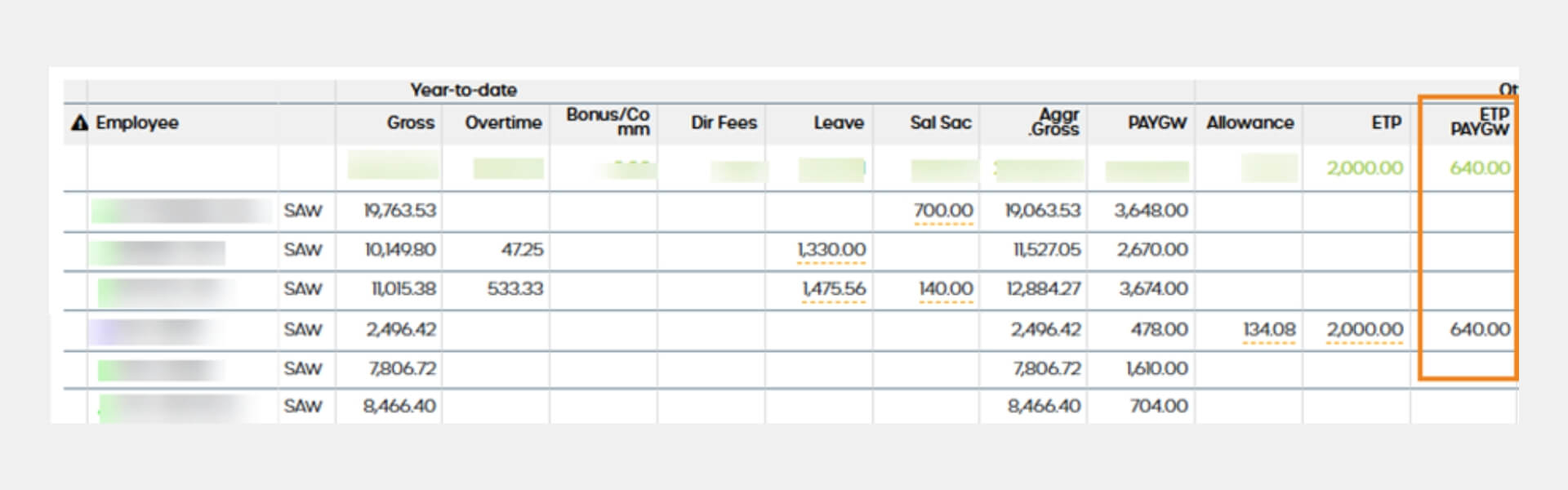

After receiving user feedback on ways to improve the end-of-year reconciliation, we have added an additional column to the STP report.

The new column is for ETP PAYGW and will allow users to easily compare the STP Report with the STP Totals

Reconciliation Report.

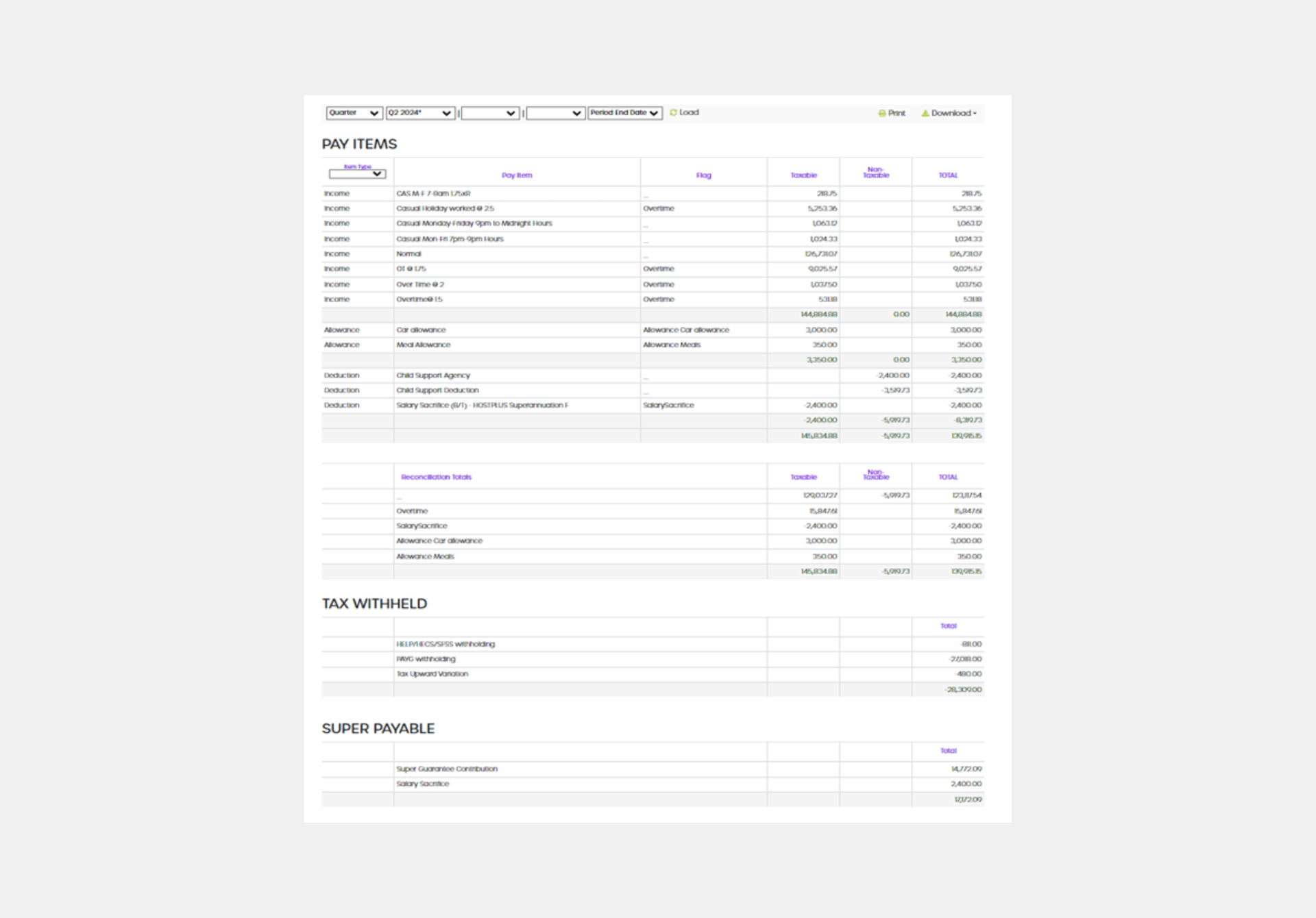

STP Totals Reconciliation Report

Under STPv2 requirements, detailed itemised reporting needs to be provided to the Australian Tax Office (ATO). The new STP Totals Reconciliation report assists in the reconciliation of the data.

The data is displayed based on the STP date, but the period end date can also be selected. This report replaces the old Totals Reconciliation report.

June 2024

FAIRWORK – JUNE 2024

FAIRWORK

INCREASE TO MINIMUM WAGE ANNOUNCED

The Fair Work Commission (the Commission) has announced a 3.75% increase to the National Minimum Wage and minimum award wages.

From 1 July 2024, the National Minimum Wage increases to $915.90 per week or $24.10 per hour and the award minimum wages increase by 3.75%.

Other award wages, including junior, apprentice and supported wages that are based on adult minimum wages, will get a proportionate increase.

The increase applies from the first FULL pay period on or after 1 July 2024.

NEW / AMENDED REPORT

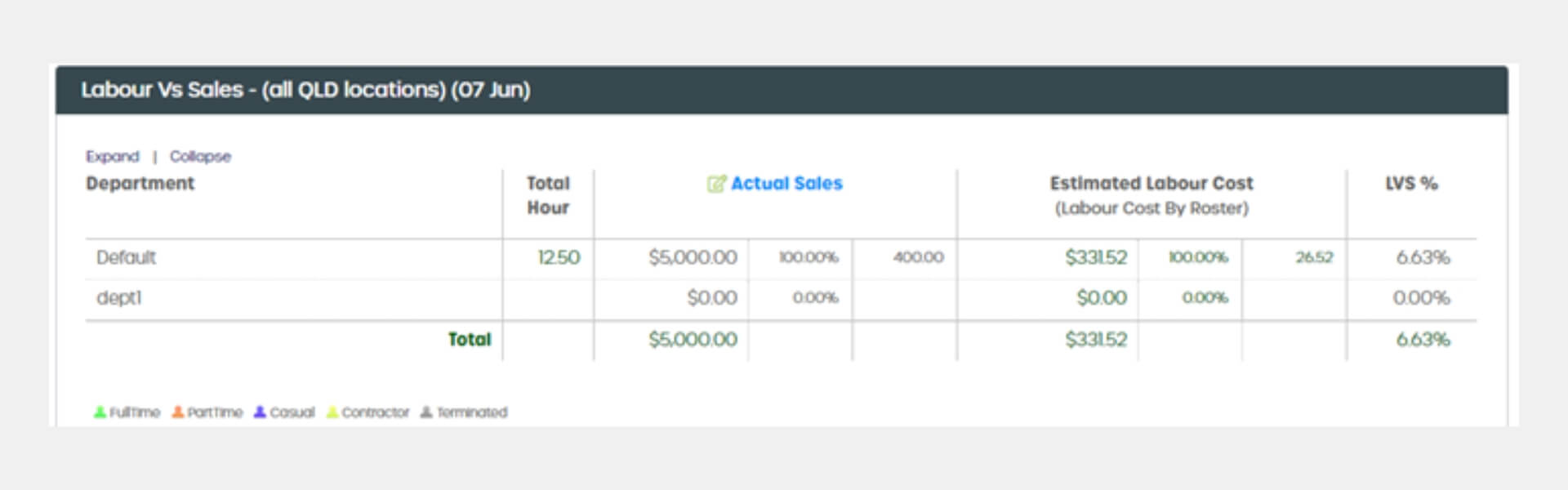

Labour Vs Sales Report

Additional information has been added to the Labour Vs Sales report. This report now displays:

• Total hours

• Sales per hour

• Cost per hour

EMPLOYEE SELF SERVICE

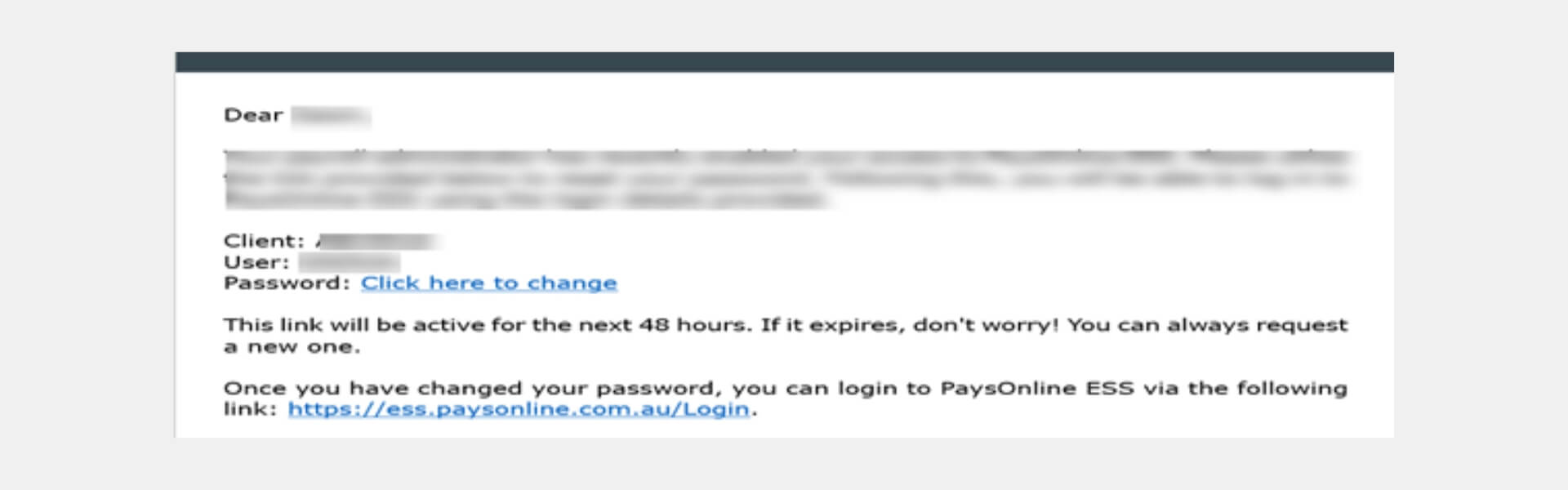

ESS Login Details Email

After recent user feedback, we have amended the email sent to new hires to include the Employee Website. The email will also advise users that the link will expire in 48 hours instead of the previous 24-hour expiration.

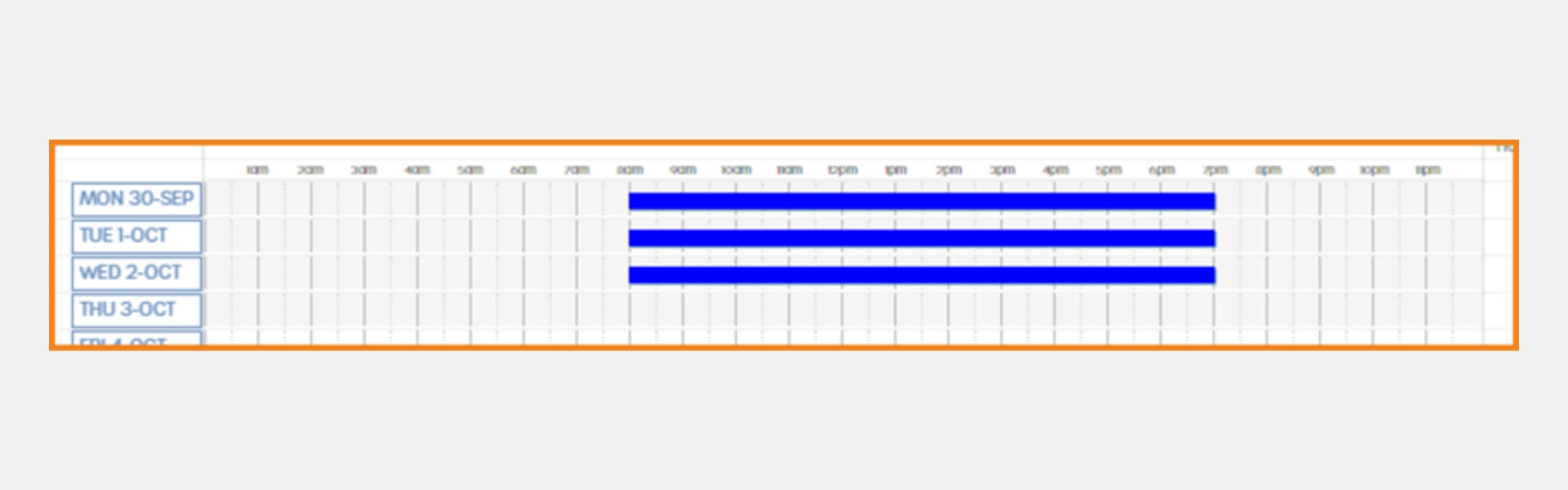

ROSTER UNAVAILABILITY

Employees are now unable to mark themselves as unavailable (if the feature is enabled) if a roster has been published. The published roster period will appear grey.

May 2024

NEW / AMENDED REPORT – MAY 2024

NEW / AMENDED REPORT

Age and Tenure

We have added age and tenure columns to the Personal Details Reports and Active Employee List.

ROSTER

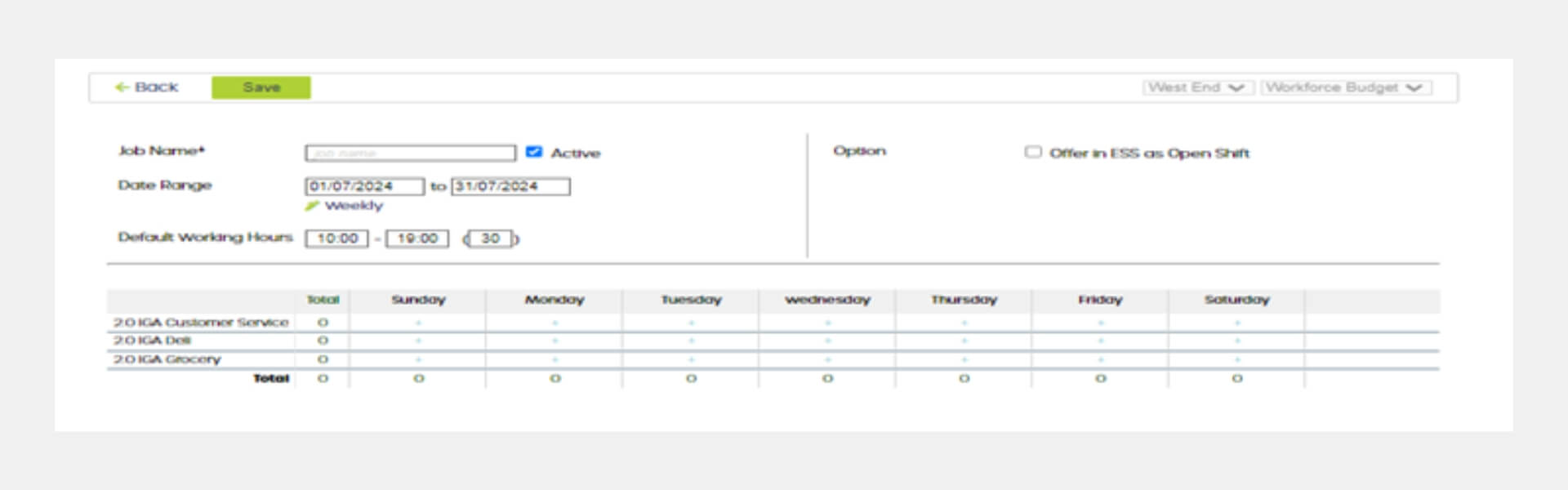

Workforce Budget Enhancement (Time and Attendance clients only)

The Workforce Budget update enables setting up multiple roles with simultaneous start times. Open/ unfilled shifts can be sent to employees.