Pay

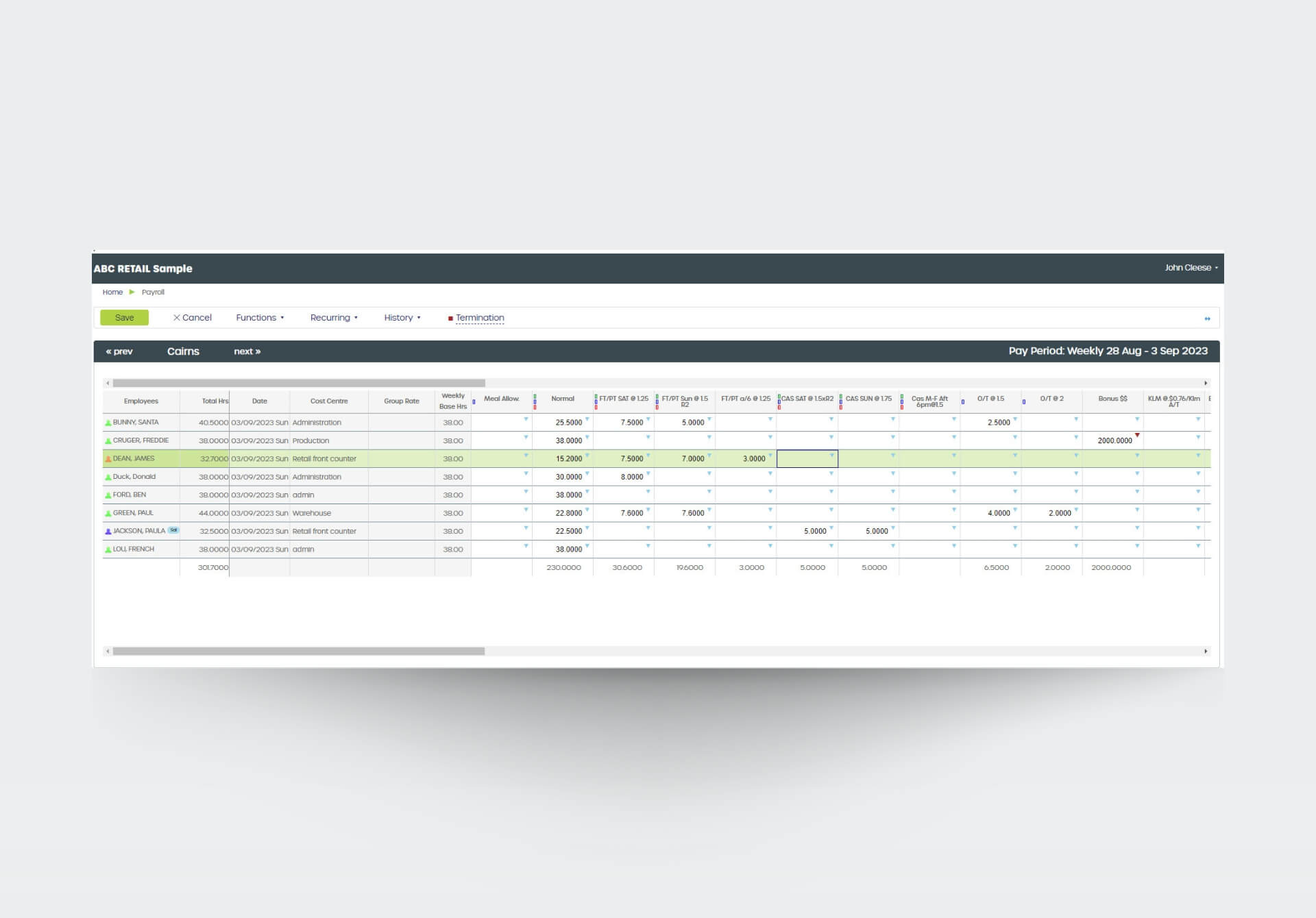

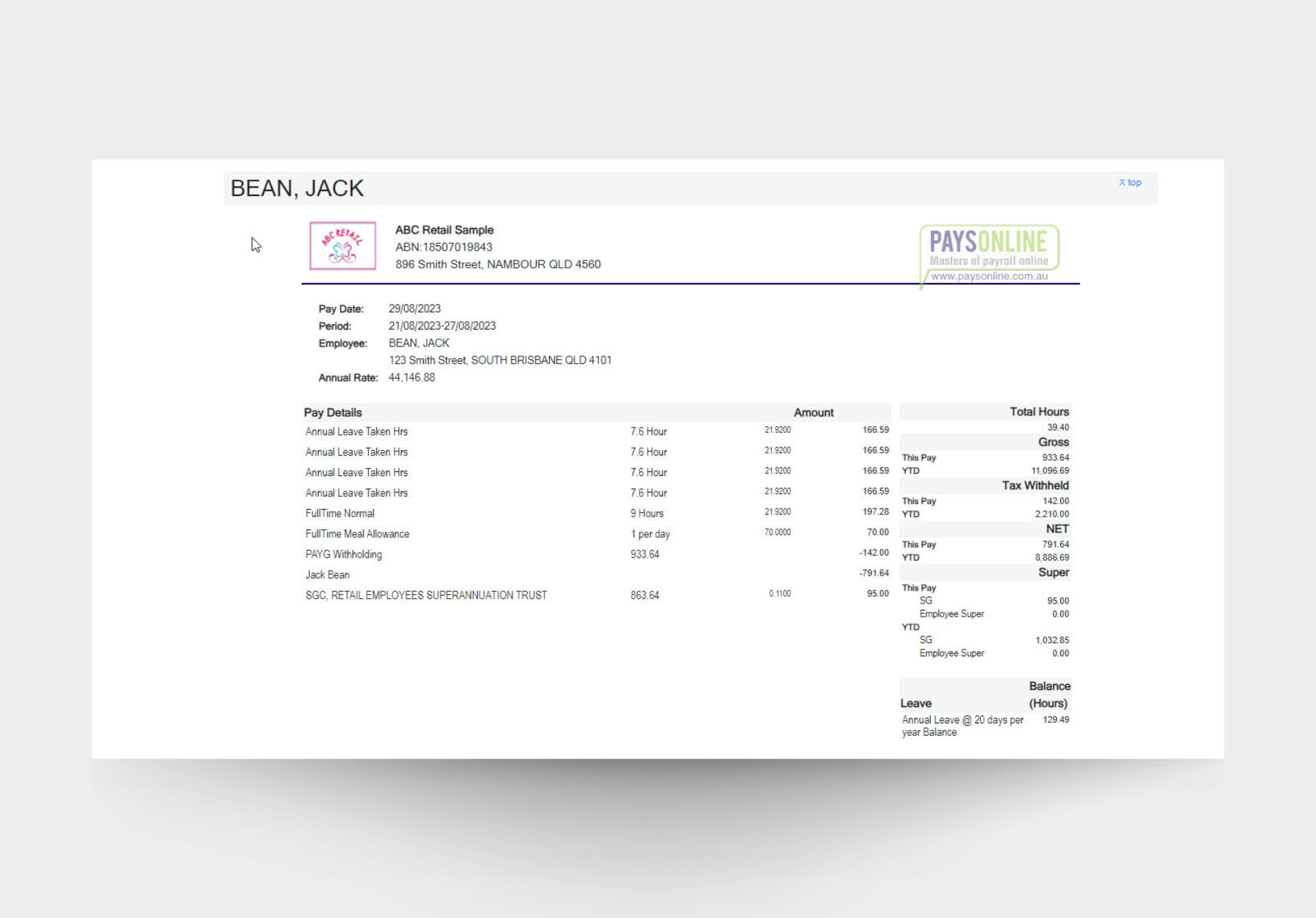

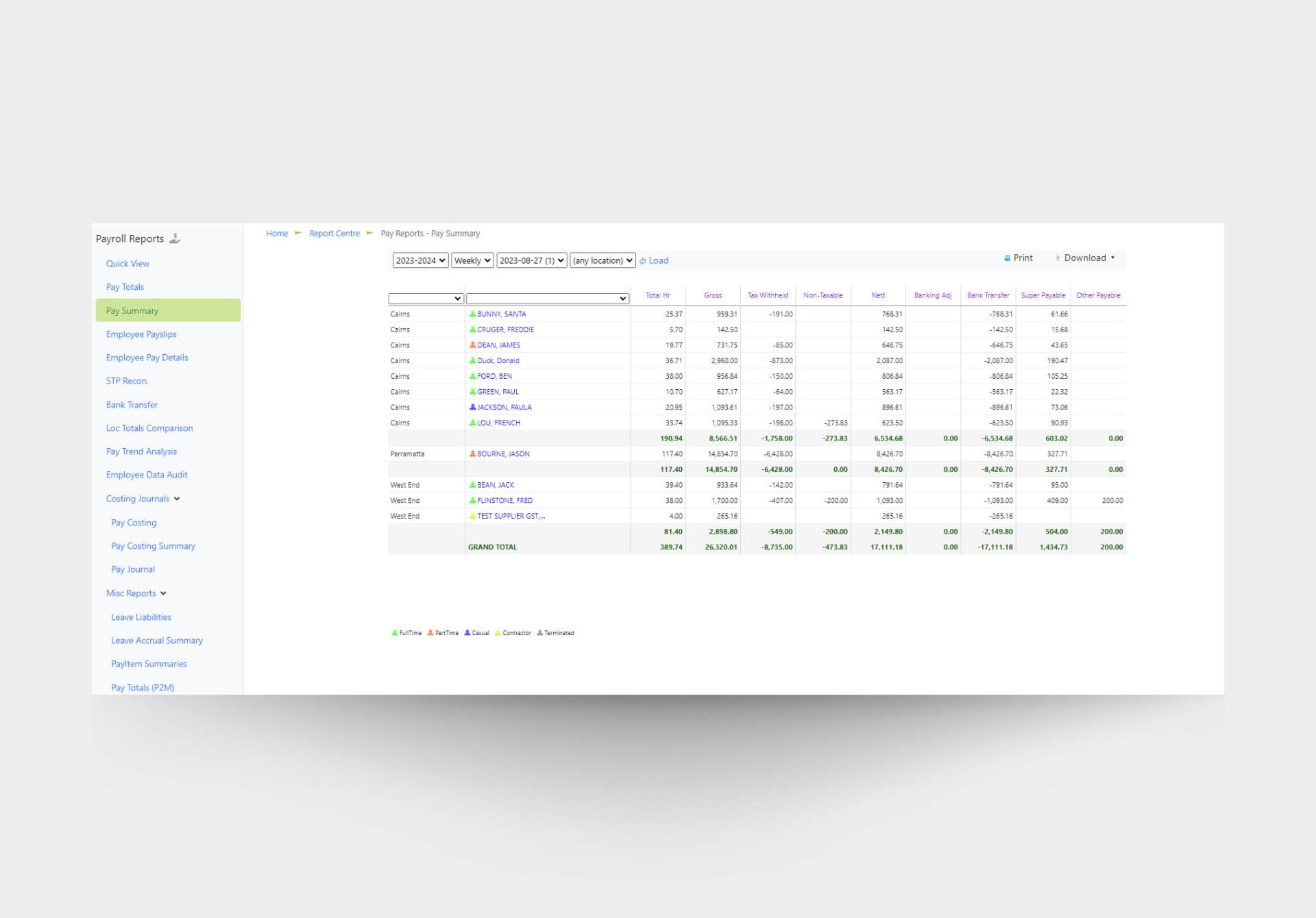

Seamless and accurate payments

Expense Management

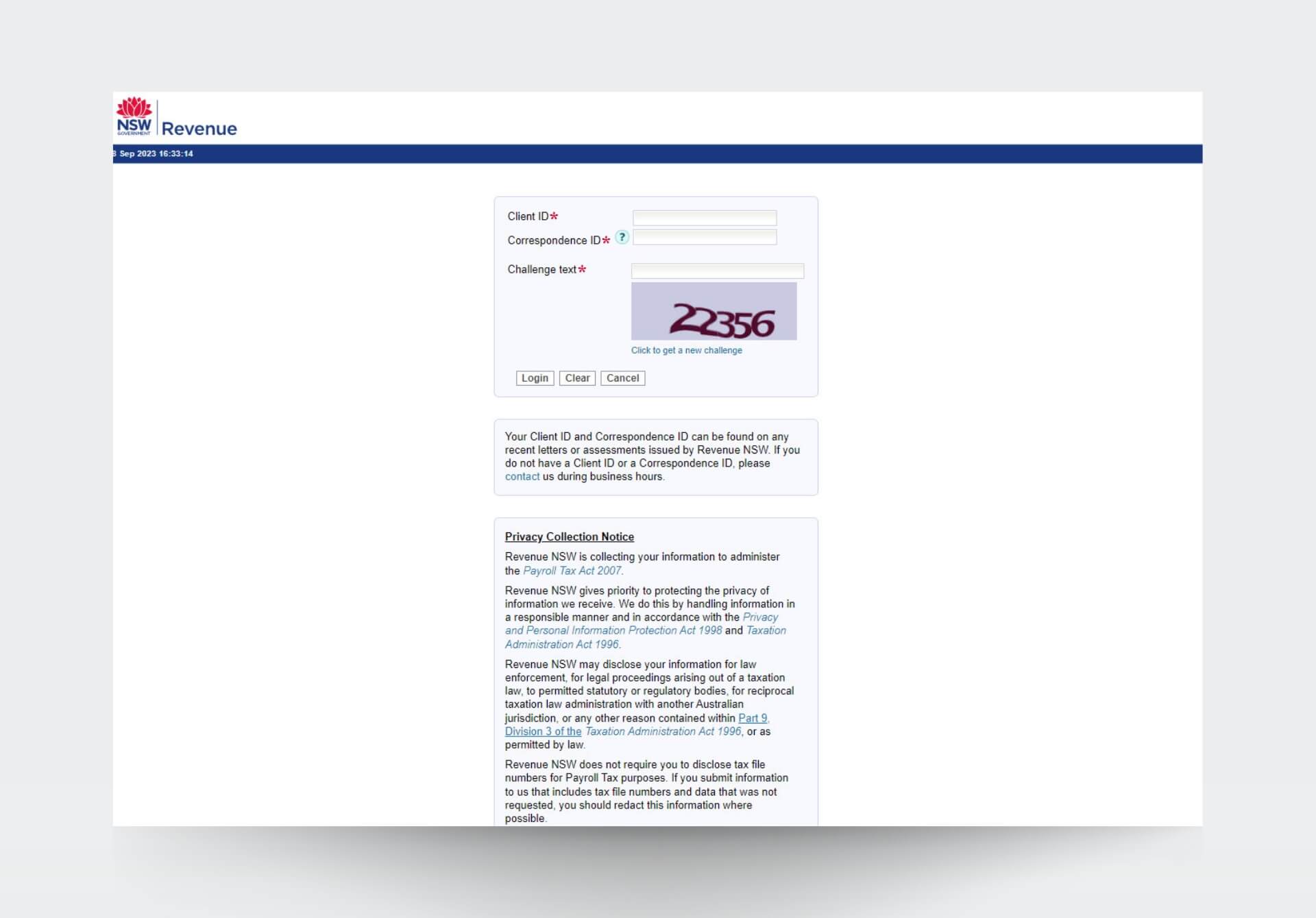

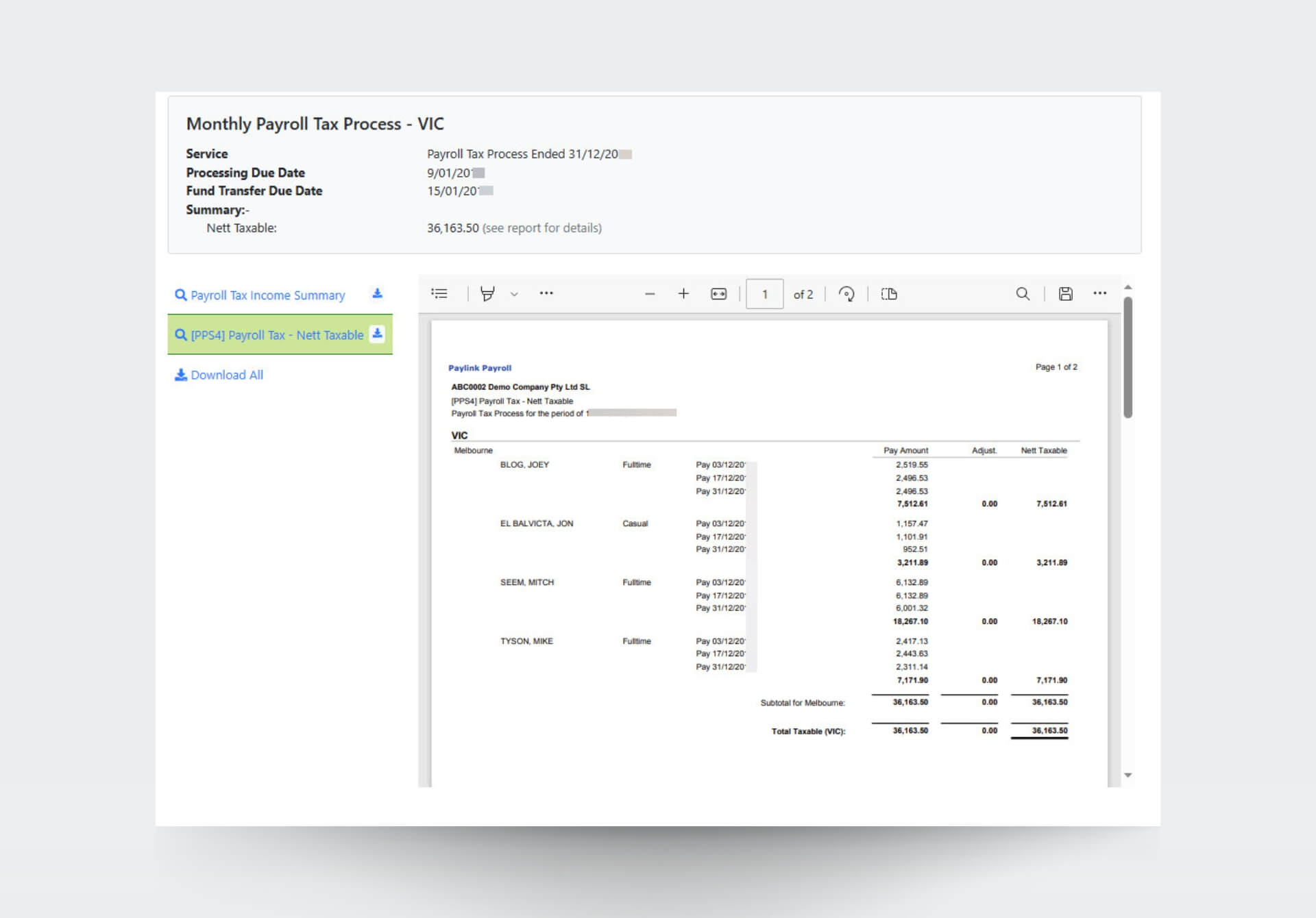

Payroll Tax Management

Take control of your payroll tax obligations effortlessly. With PaysOnline, we offer two flexible options to assist you. You can choose to receive a comprehensive report that guides you through the process of completing your payroll tax obligations directly with the Office of State Revenue (OSR). Alternatively, for added convenience, you have the option to designate us as a user in the OSR system, and we’ll handle the tax filing process on your behalf.

PAYG Management

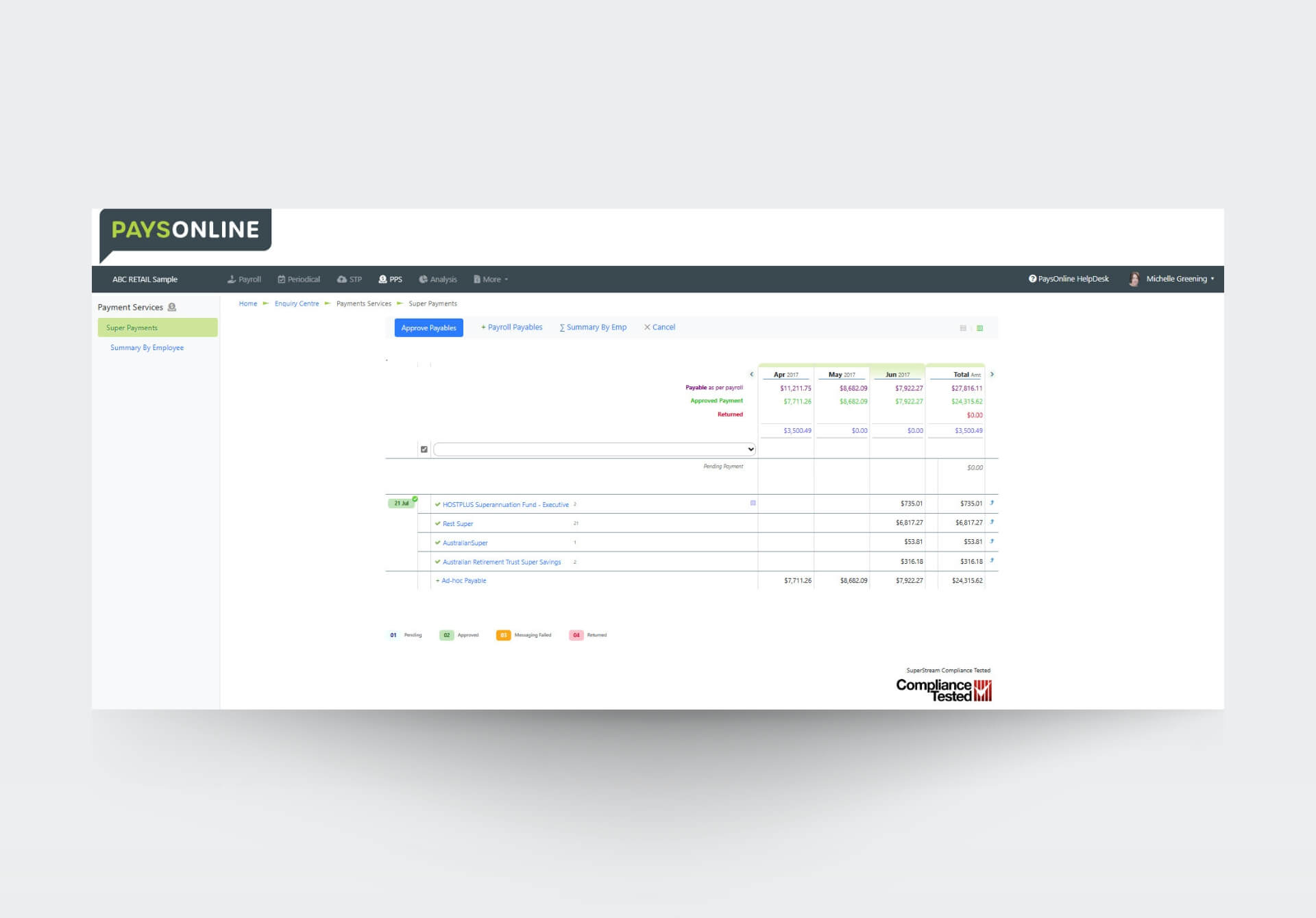

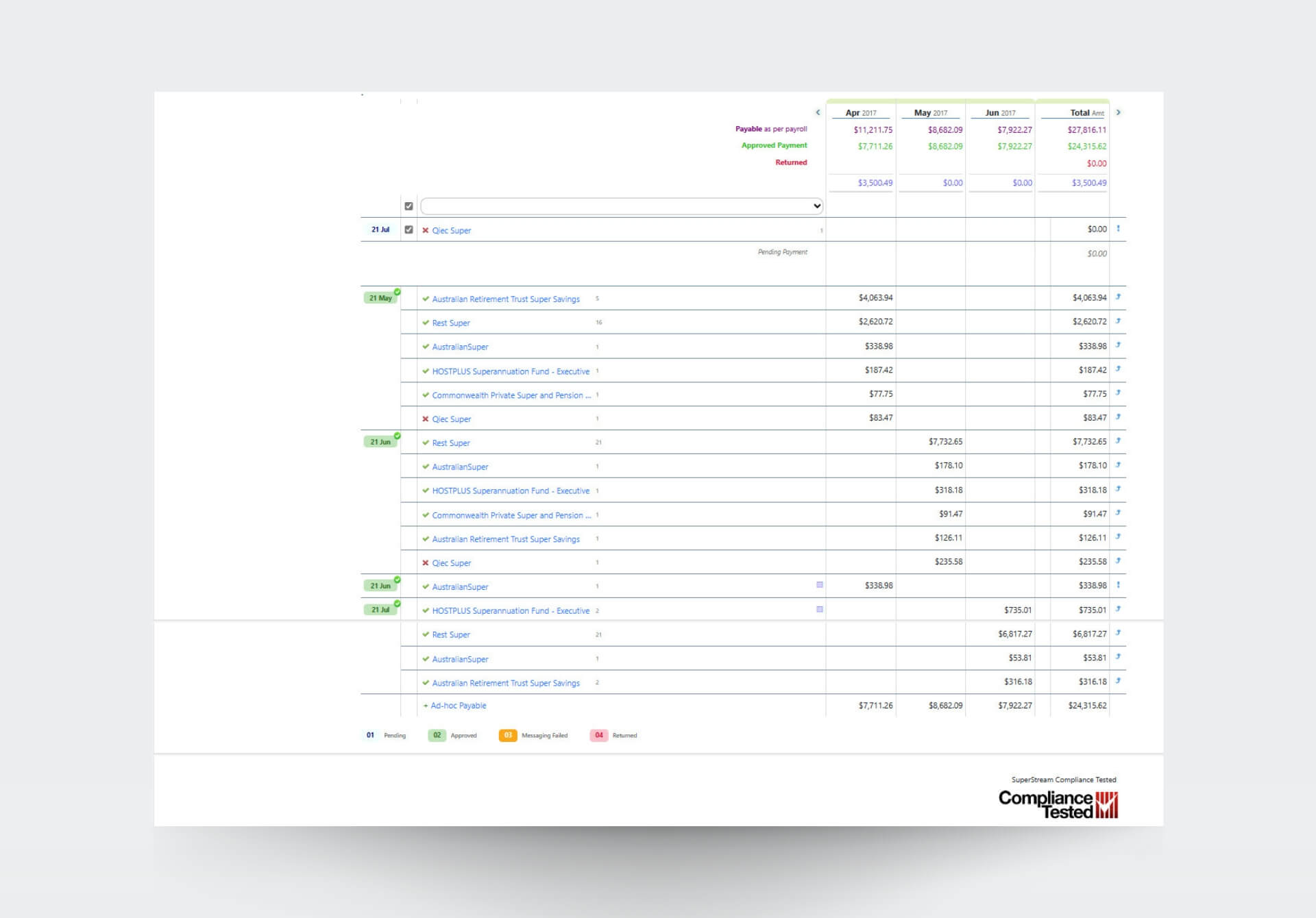

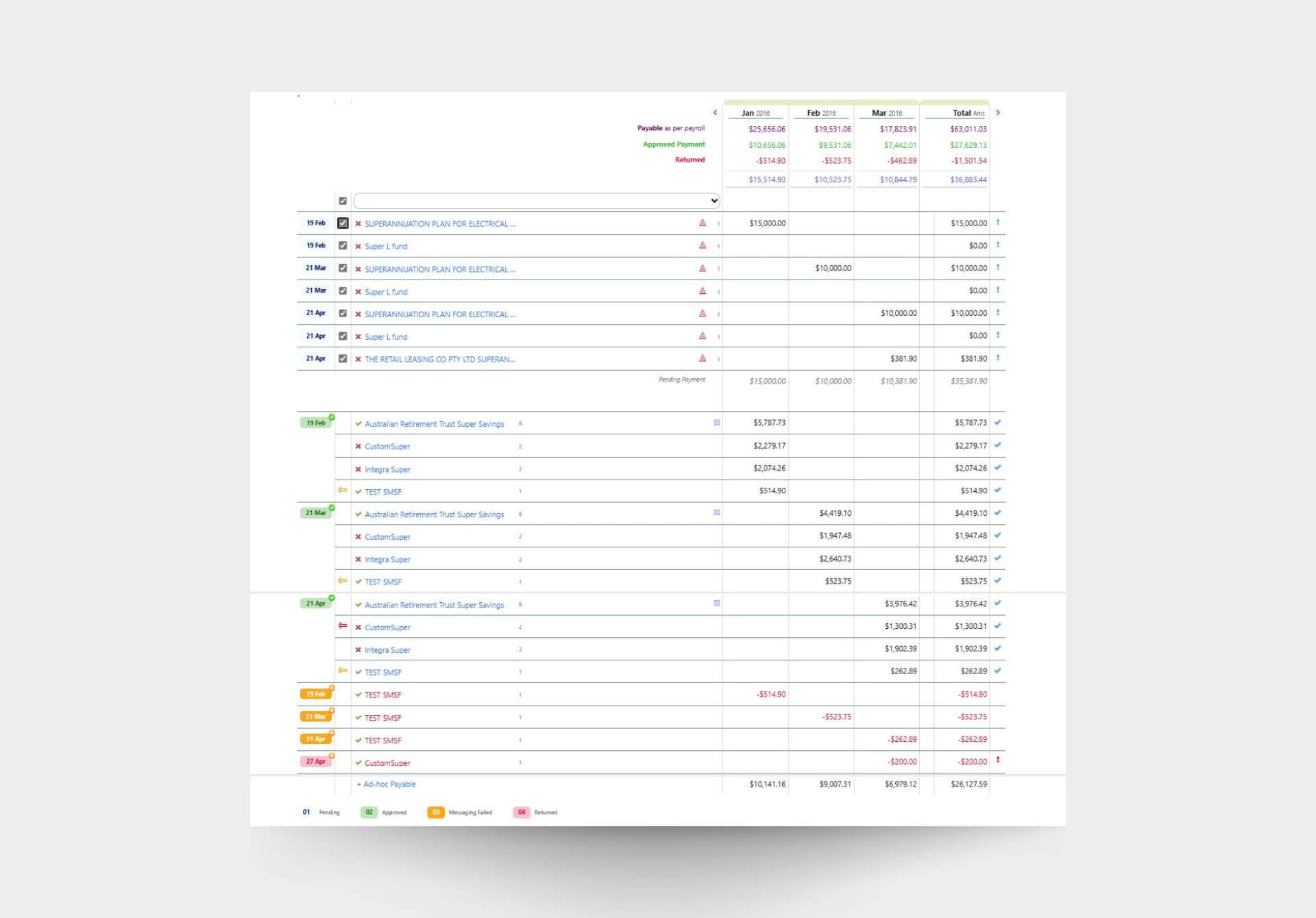

At PaysOnline, we take care of all your superannuation processing and payment needs. This includes calculating various types of superannuation liabilities, like your employer’s Superannuation Guarantee Charge (SGC) amounts, employee co-contributions, and salary sacrifice. Not only that, but we also make the liability payment on your behalf.

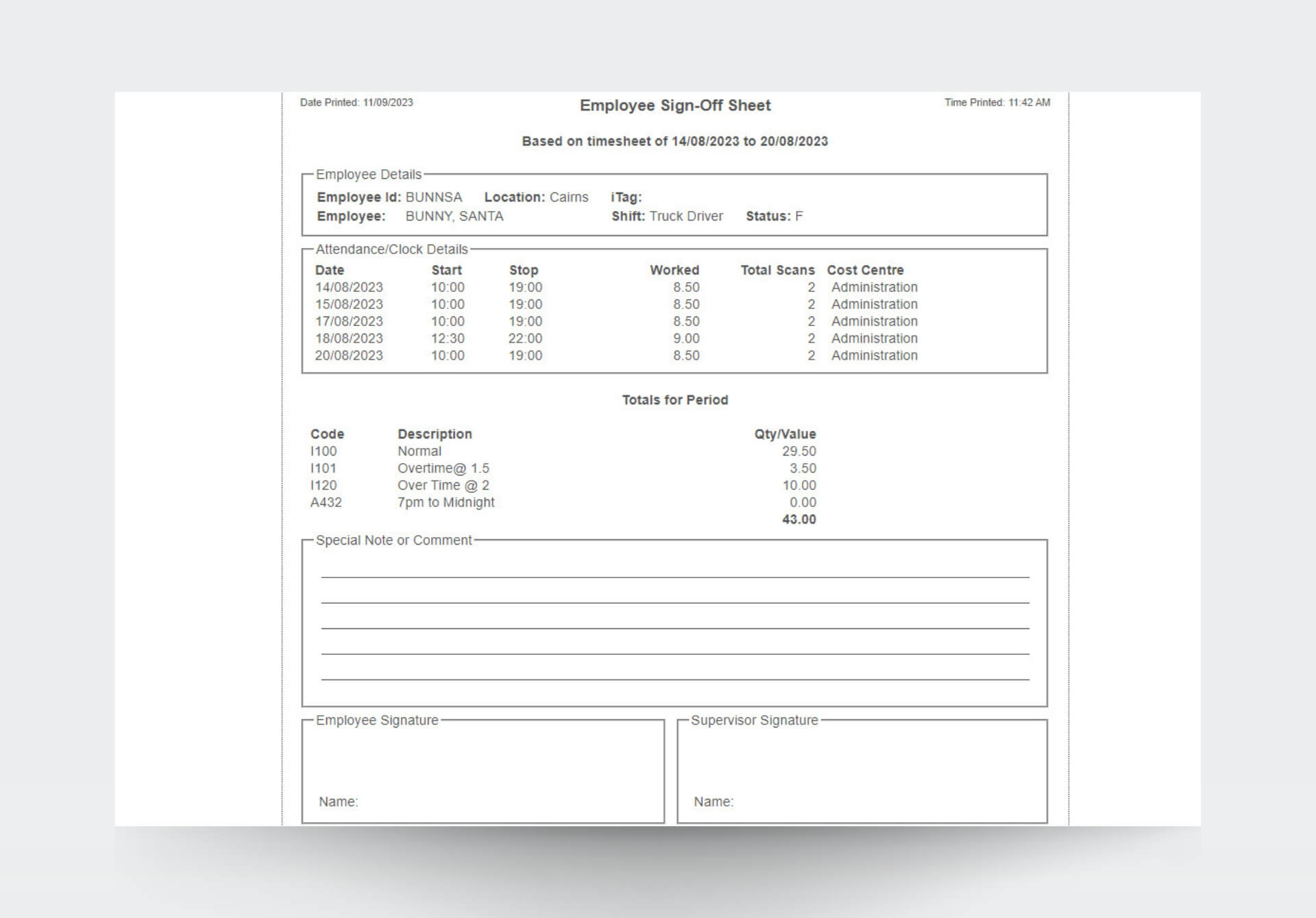

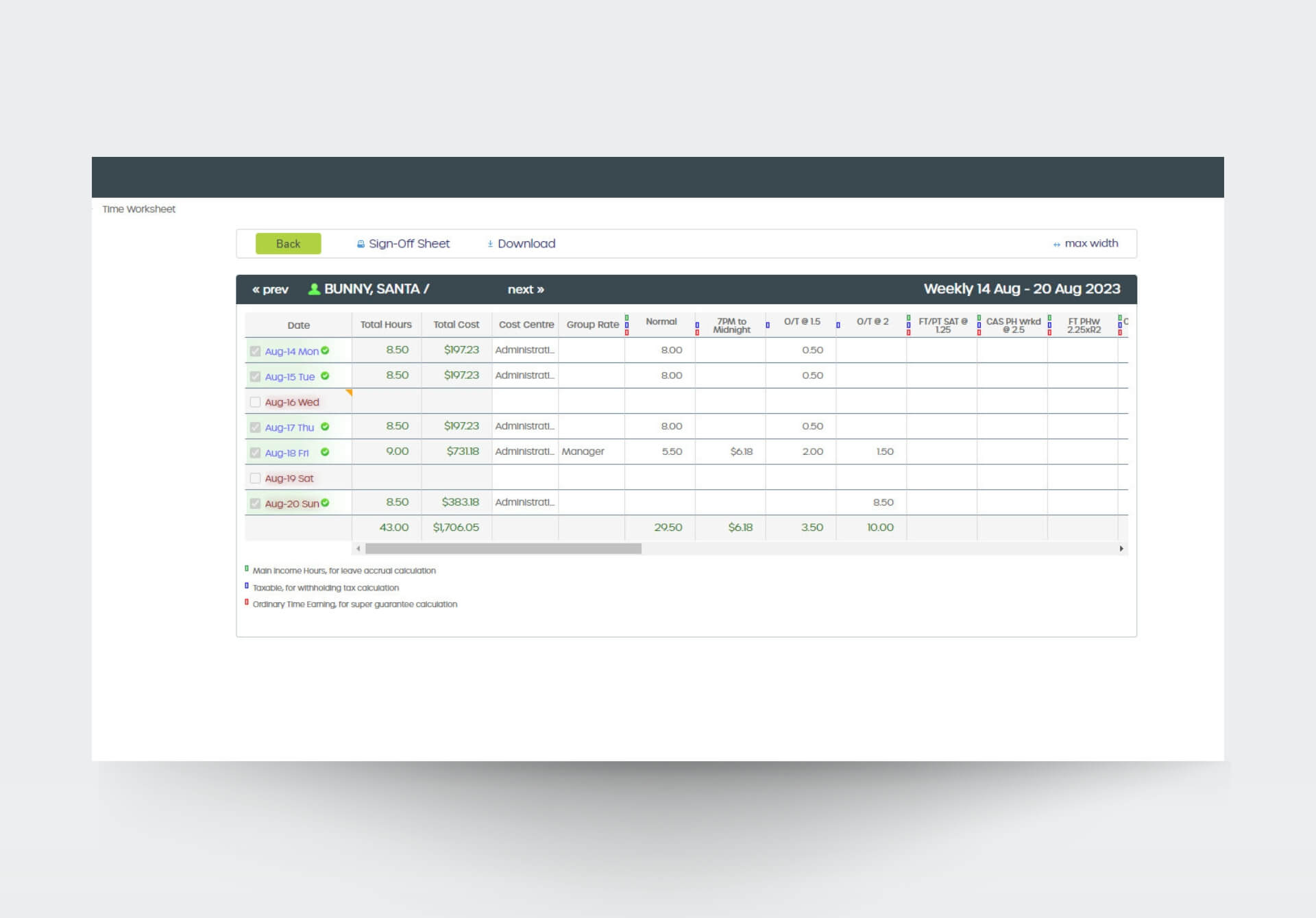

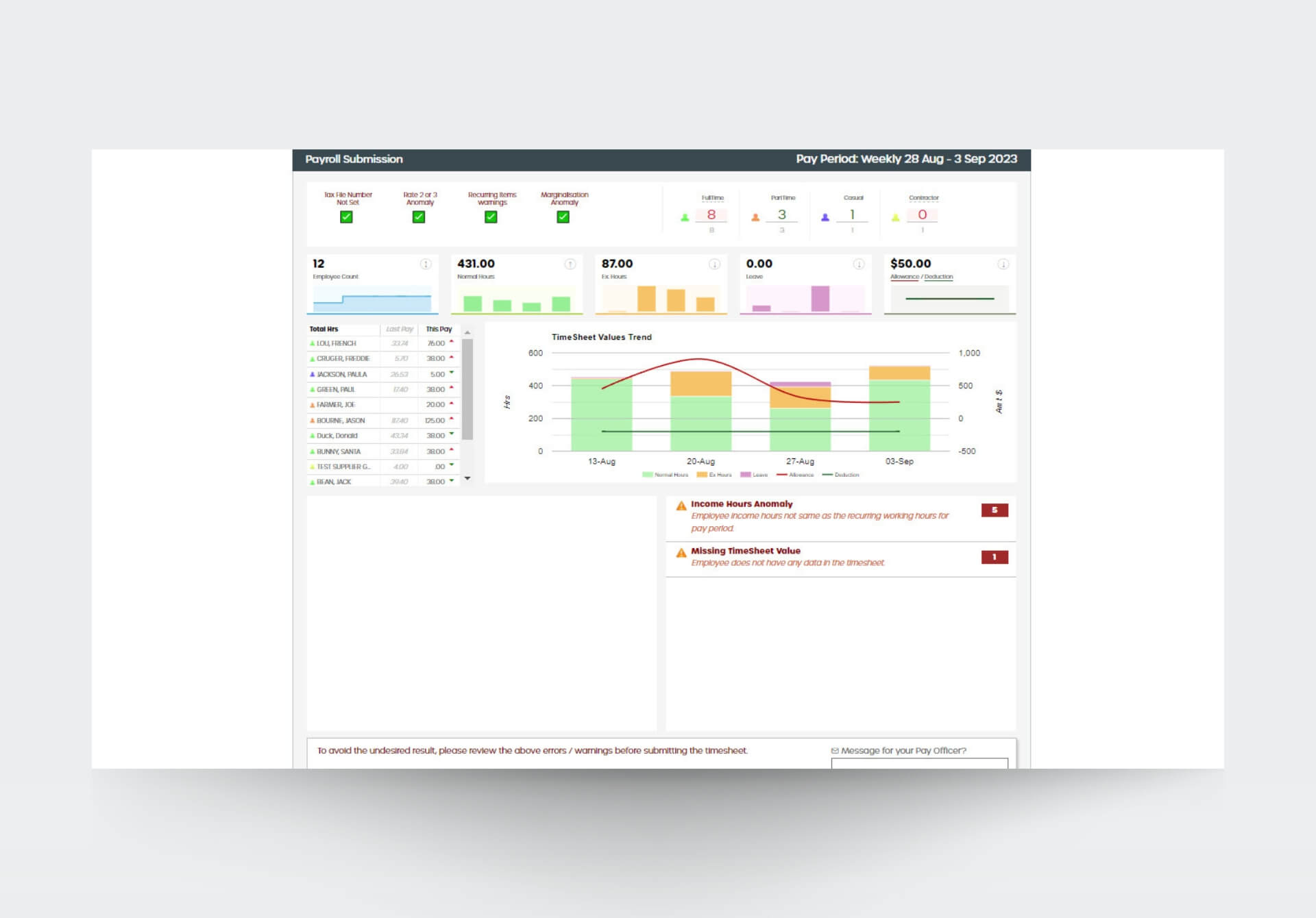

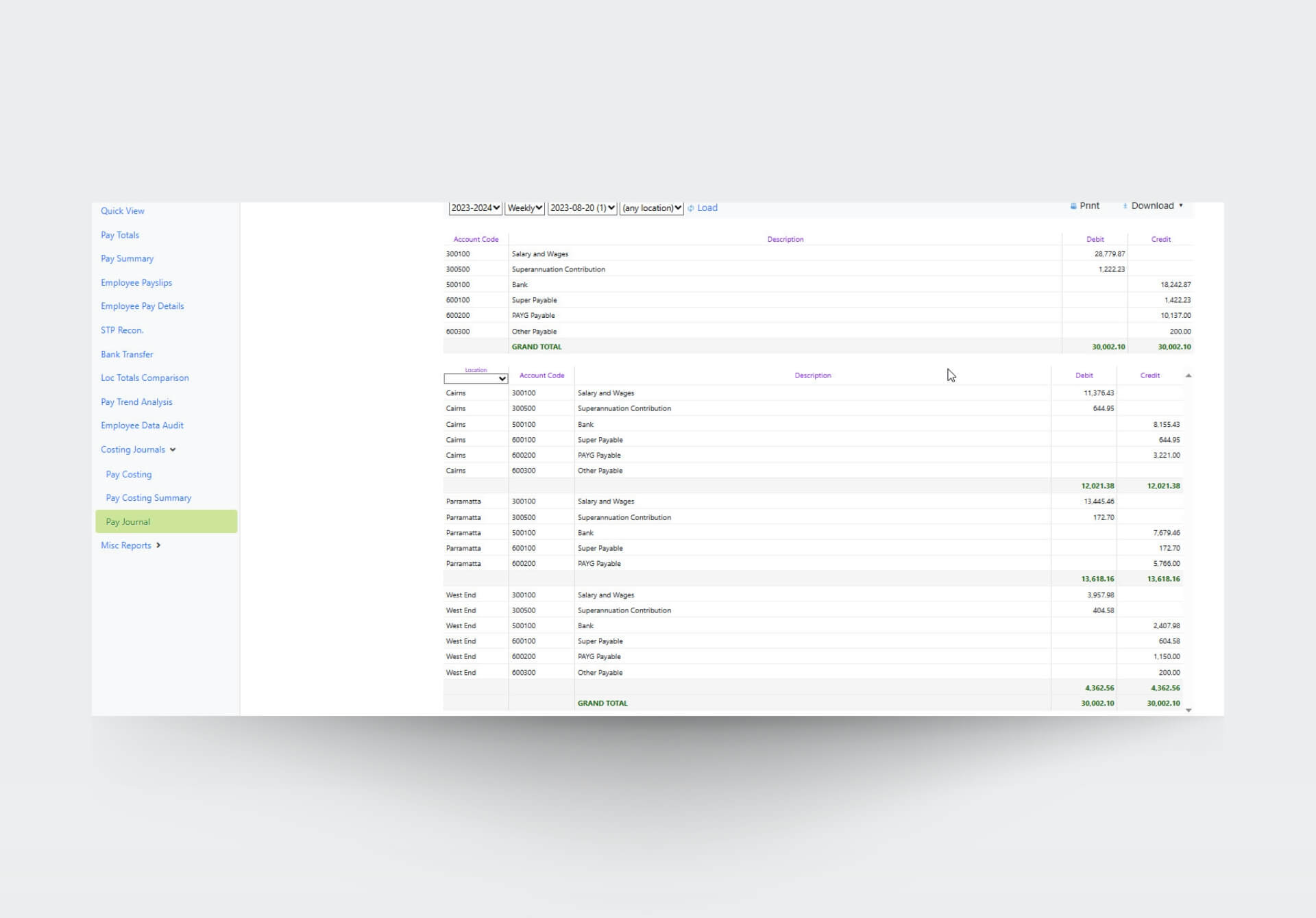

Our system ensures that data is validated at the point of submission, making it easier for you to reconcile payments with a full audit trail. With our seamless PaysOnline Payment Service (PPS), there’s no risk of transposition errors when entering data, and you can make one centralised payment for multiple funds.

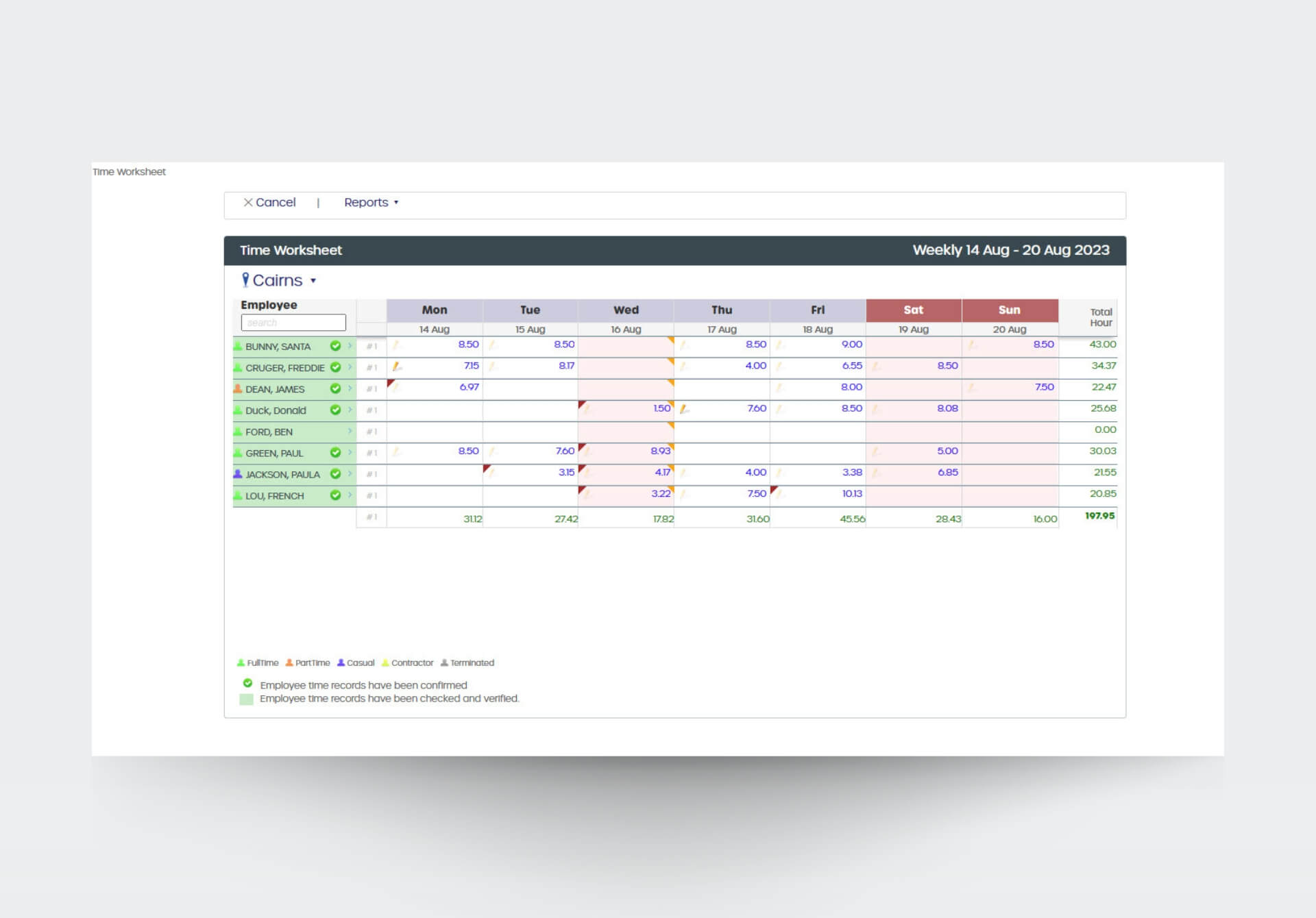

- Enjoy cloud-based convenience for making changes, running reports and submitting payroll information from anywhere, anytime.

- The scalable design adds flexibility and allows you to customise the system to fit your company’s unique needs.

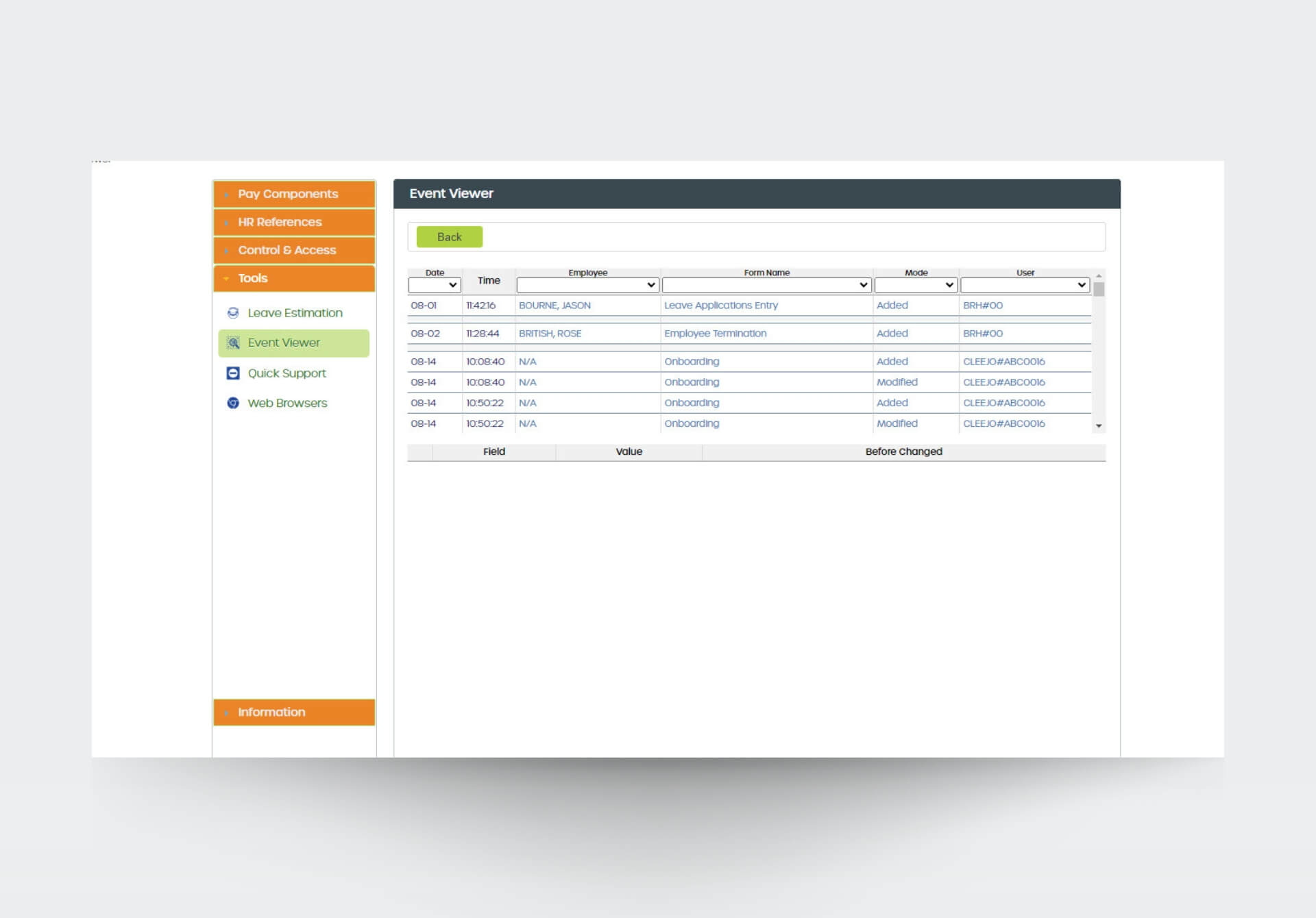

- Remain proactive in payroll by easily delegating tasks to multiple users within your organisation. Customisable access levels for separate duties ensure confidential information is protected.

- Automatically update payroll with time data and employee changes without re-keying information.

- Simplify manual processes by adding recurring payroll items to employees.

Additional available features

-

Seamless cloud-based console

-

Superannuation calculations

-

Paperless onboarding for new employees

-

Employee console - upload licences, view training, complete custom forms

-

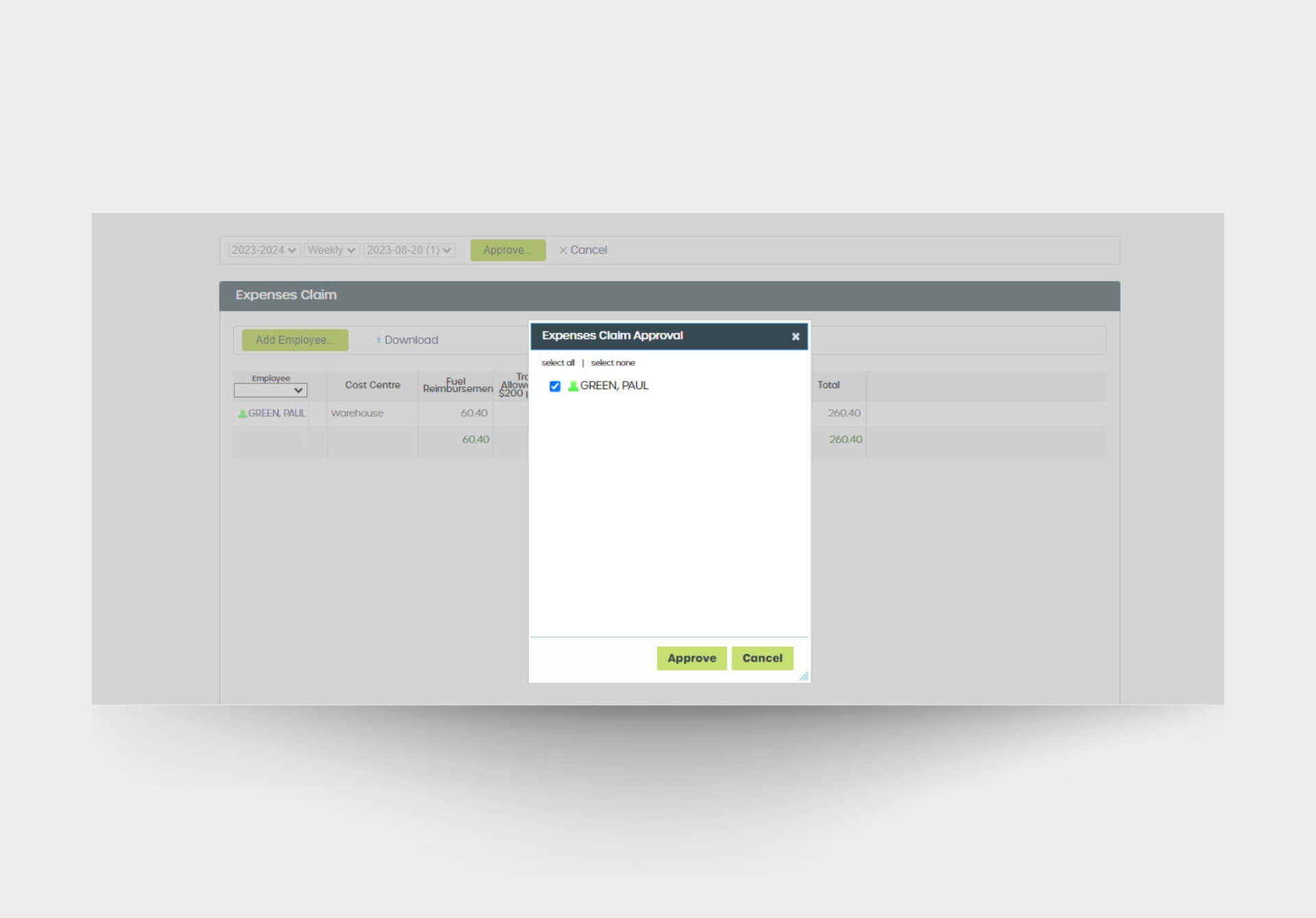

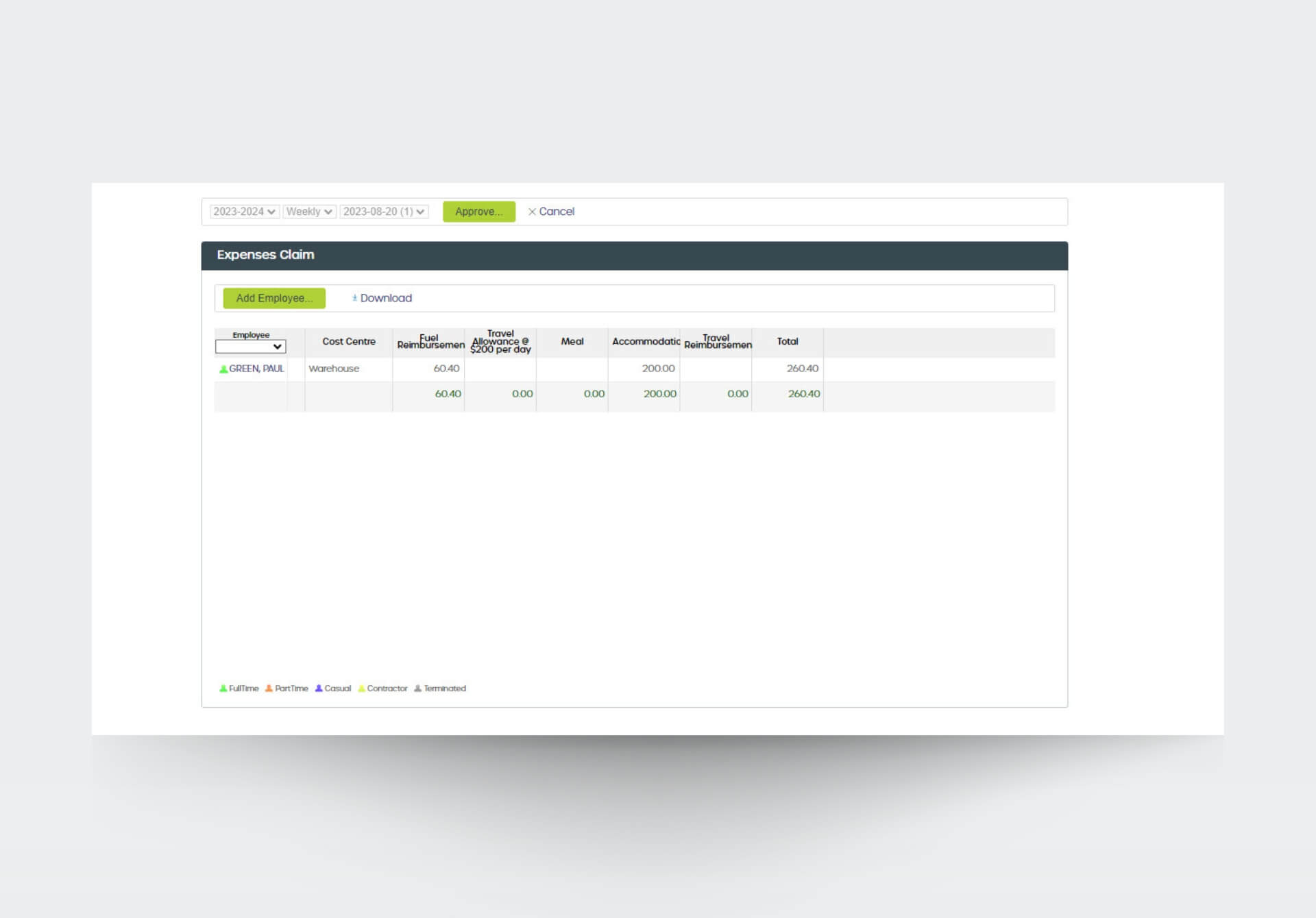

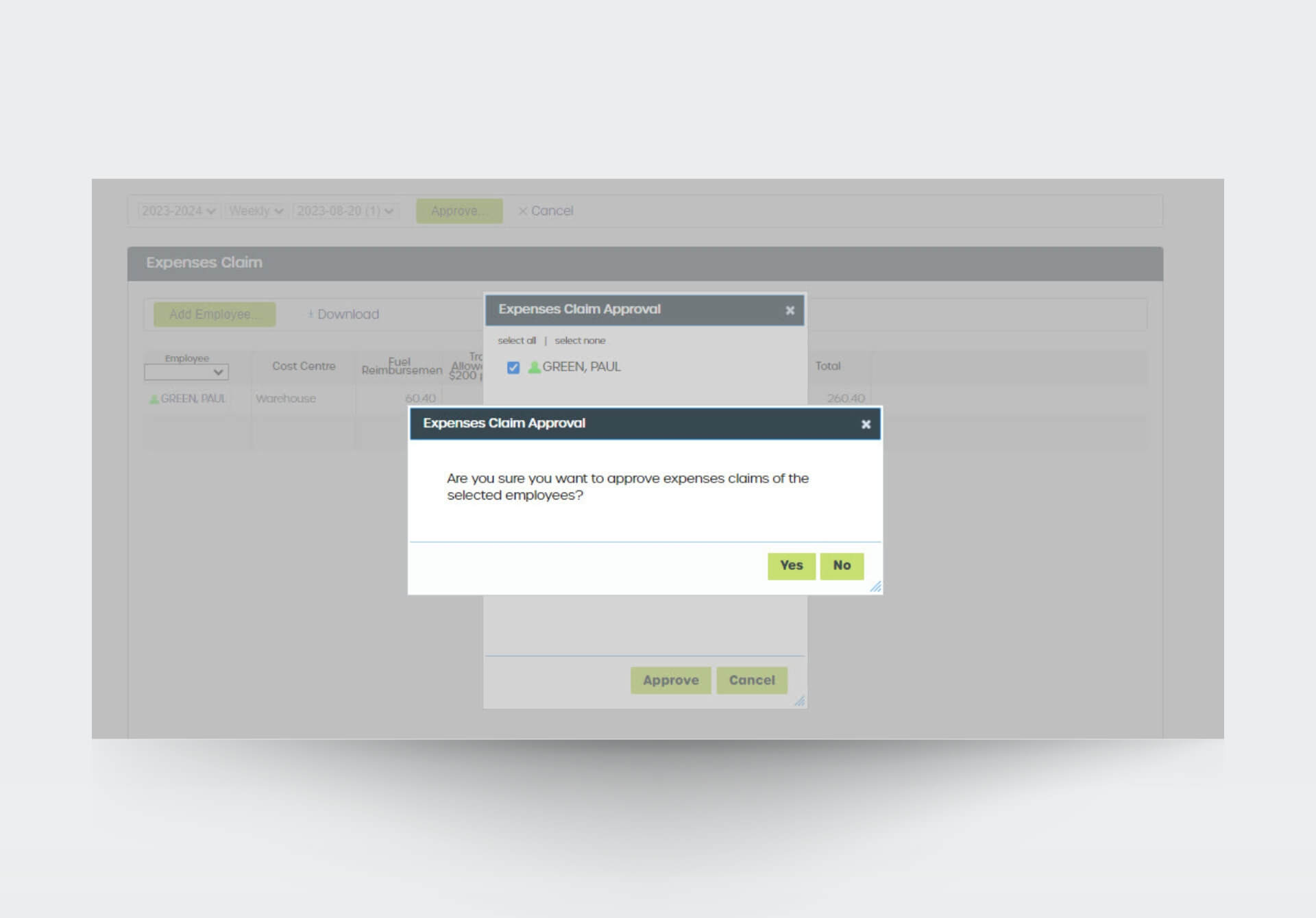

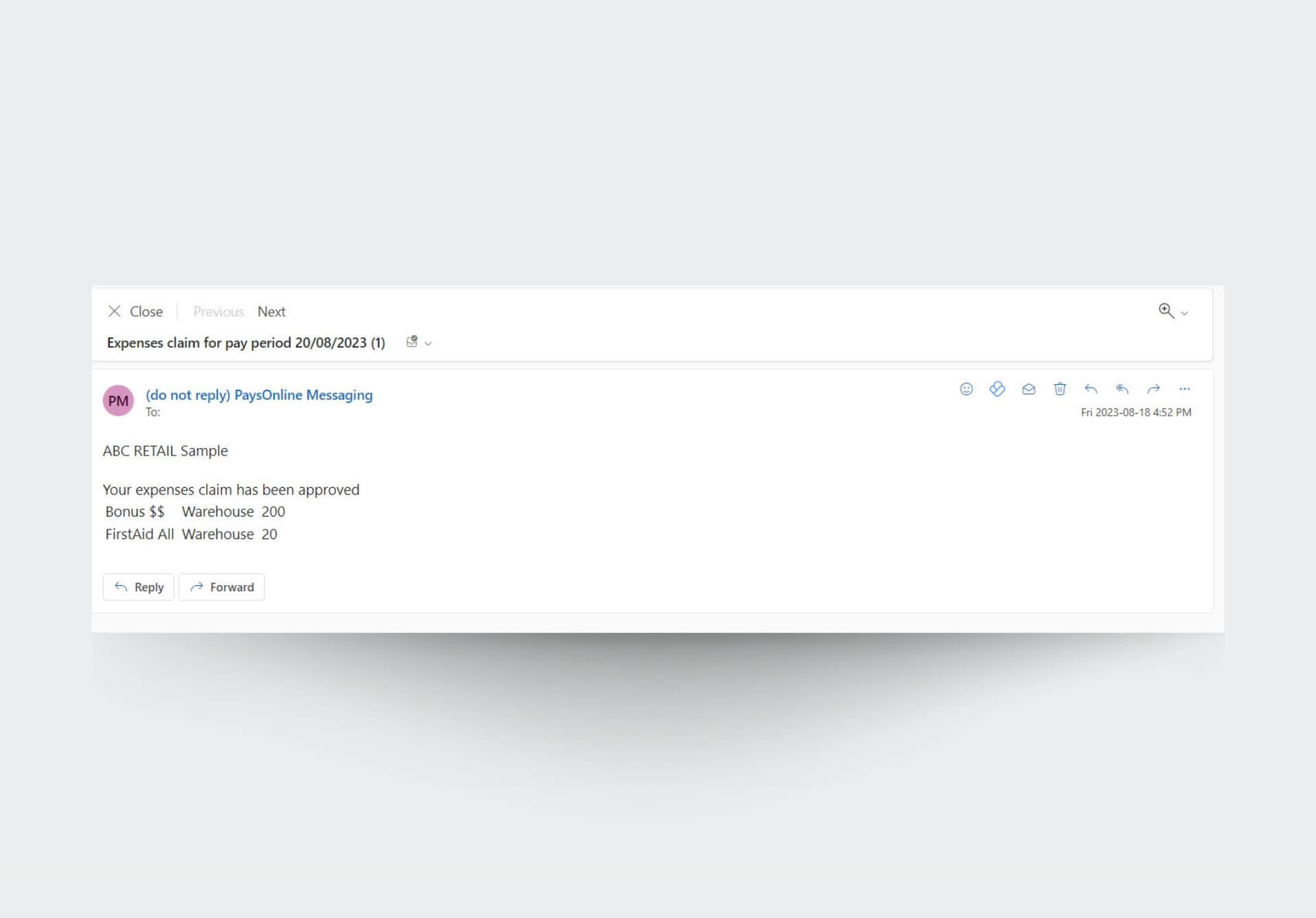

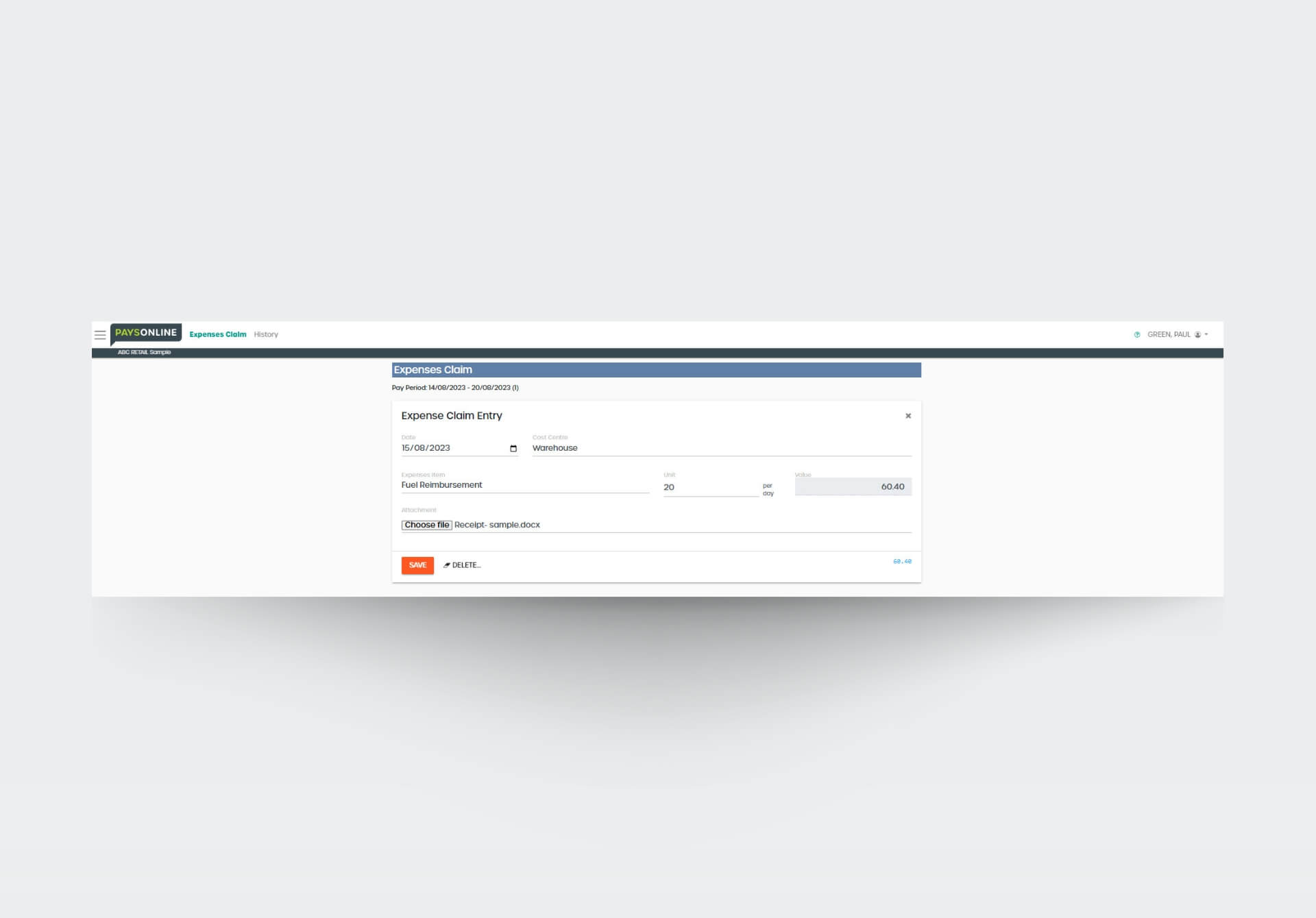

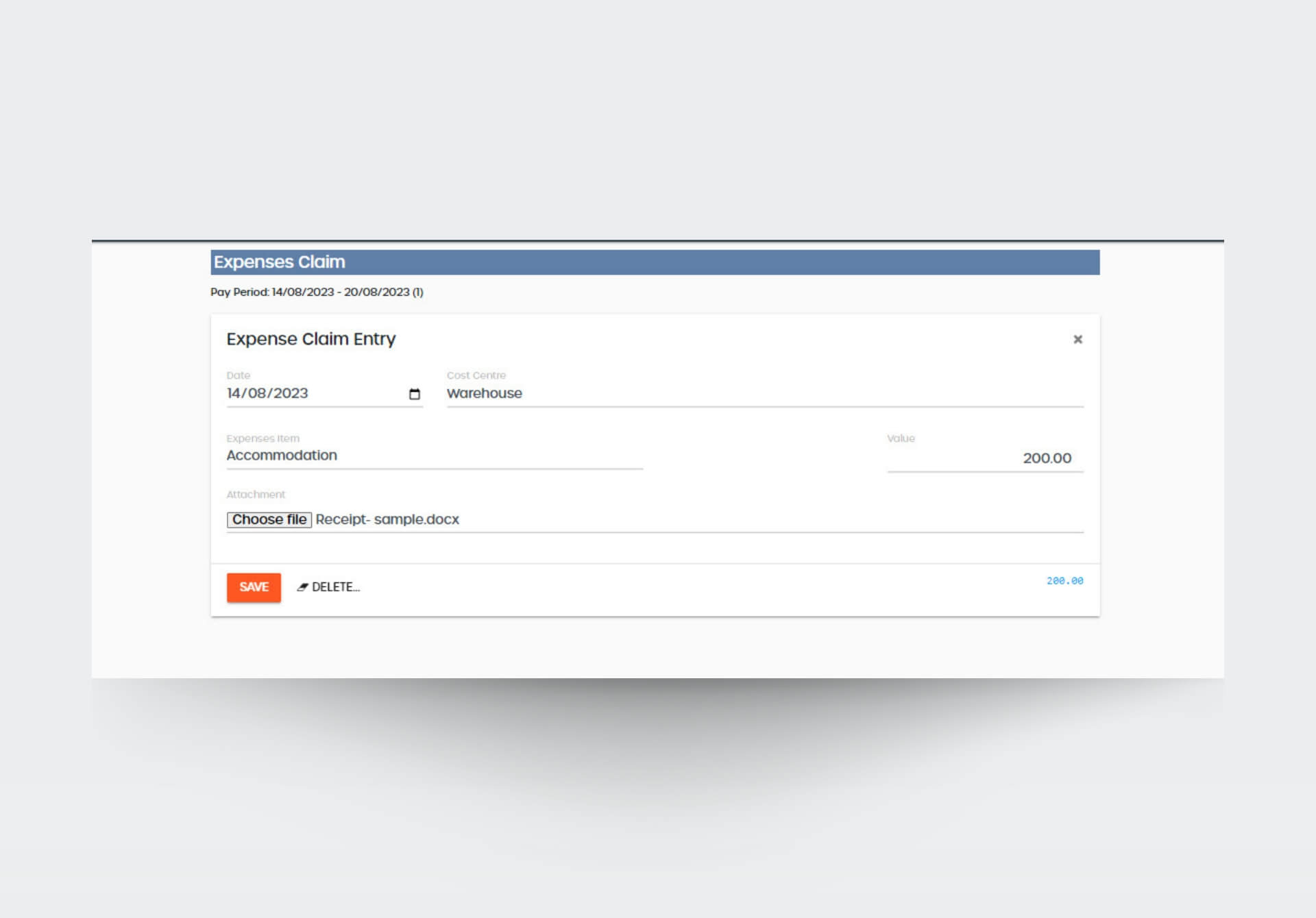

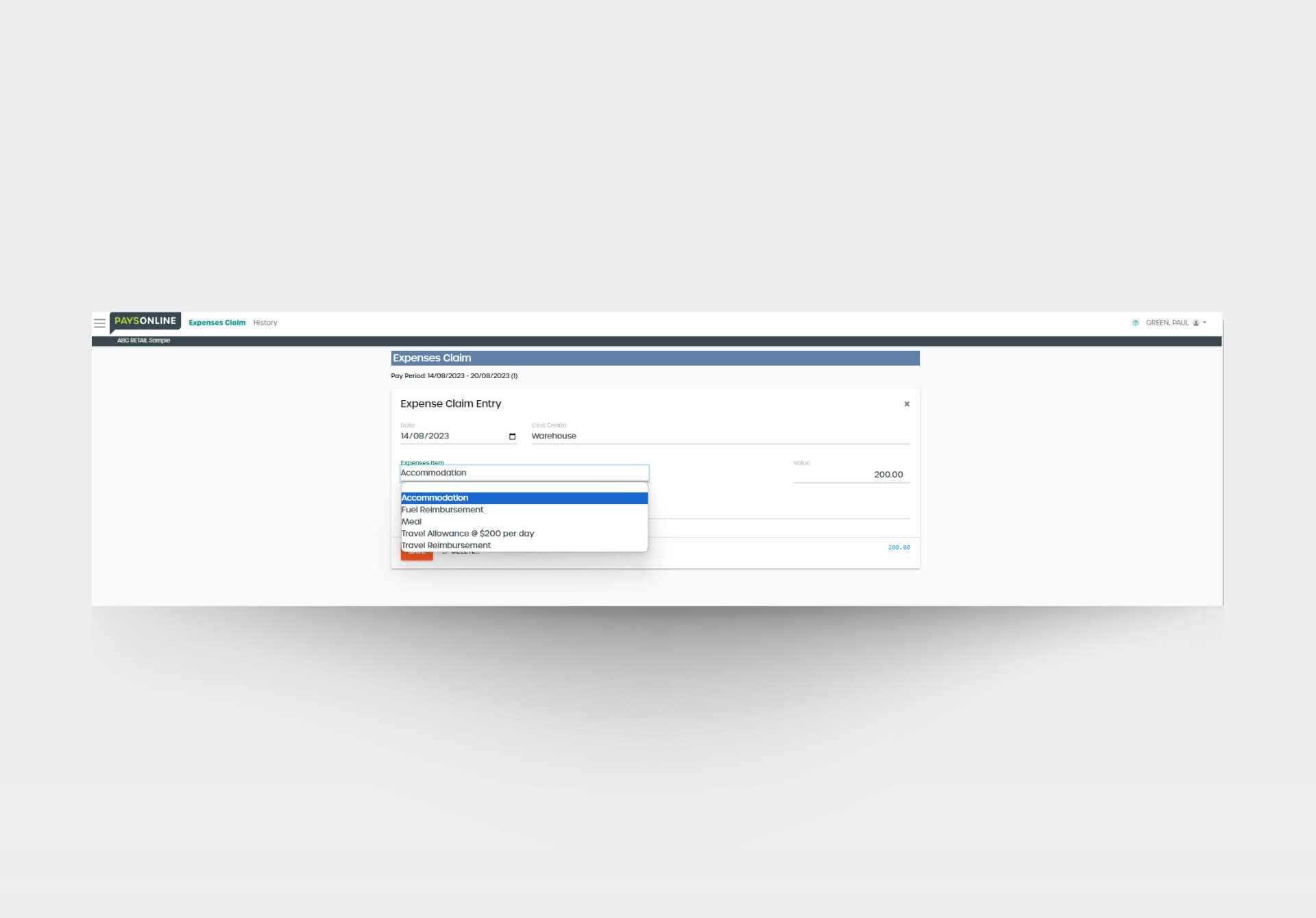

Employee expense claims

-

Termination calculations

-

Connect to Xero

-

General Ledger Mapping

-

PAYG, BAS, IAS payments

-

Workcover annual returns

-

Payment of wages - Funds Transfer (FTS), Australian Banking association (ABA)

-

Payroll tax Reporting and lodgement

-

Compliant reporting

-

Gold certified super stream payments

-

Multiple pay processing frequencies

-

Flexible payroll schedules

-

Roster Management and reporting

-

Time and attendance reports

-

Multiple location, cost centres and departments

-

Online access for accountants

-

Employee online leave management

-

Multi level user access and self-administered control centre

-

Individual time keeping options - job sheet, web time clock, biometric scanners

-

Internal communication

-

Single Touch Payroll -Version 2 Compliant

-

Super fund validation

-

HR document delivery with electronic acknowledgement

-

HR report centre - employment details, OH&S, benefit details

-

Comprehensive HR - employment details, recruitment, reminders

-

Comprehensive HR - dashboard, employee details, curriculum vitae

-

Skill assessment, training, performance reviews, custom forms

-

Fair Work link and audit response

-

System generated (e-reminders)

-

My to do list

-

Audit control

-

Emailed Payslips

To Find your perfect plan, visit the Plans page for a detailed list of what features are included.