Payday Super and Casual Conversion – JAN 2025

Payday superannuation

Here’s what we know so far:

- From 1 July 2026, an employer will be required to make SG contributions on ‘payday’. Payday is the date that an employer makes an Ordinary Time Earnings (OTE) payment to an employee.

- Payday Super each time OTE is paid, there will be a new 7-day ‘due date’ for contributions to arrive in the employees’ superannuation fund. This provides time for the movement of funds through the payment system, including clearing houses.

- An employer will be liable for the new SG charge unless SG contributions are received by their employees’ superannuation fund within 7 calendar days of payday.

- There will be some limited exceptions:

- Contributions for OTE paid within the first two weeks of employment for a new employee will have their due date deferred until after the first two weeks of employment.

- Small and irregular payments that occur outside the employee’s ordinary pay cycle would not be considered a payday until the next regular OTE payment or ‘payday’ occurs.

Recognising late contributions

- Employers will need to pay SG contributions on payday, so they are received in an employee’s super account within 7 calendar days of payday.

- If funds are not received in an employee’s superannuation account within 7 days, the employer will be liable to pay the SG charge, even ahead of the ATO issuing an assessment.

- An employer in this situation should make contributions to their employee’s superannuation fund as soon as possible. This will minimise their liability and penalties.

PaysOnline has the system capabilities to release the required legislation changes, once the final specifications are released by The ATO.

Casual Conversion – Do you know your obligations?

What is Casual Conversion?

Casual conversion is a right under the National Employment Standards (NES) for casual employees to become a permanent employee (full-time or part-time) if they want to. Casual employees have this right if:

- they were employed before 26 August 2024

- they’ve completed at least 12 months of work with their employer and meet certain criteria, and

- their employer does not have reasonable grounds to not convert them.

Offering casual conversion under the transitional rules

- Was you casual employee employed before 26 August 2024? – If no, then no action is required

- Your business has 15 or more employees – (if you have fewer than 15 employees you are not required to offer casual conversion)

- Has the employee been working with you for at least 12 months? – If YES, within 21 days of their 12-month anniversary, you must assess whether they are eligible and either offer them a conversion in writing or explain in writing why you are not offering conversion.

- Has the employee worked a regular pattern of hours on an ongoing basis for at least 6 months of their first 12 months of employment?

- Establish if the employee could continue working this regular pattern of hours as a permanent employee without significant changes – Significant changes could include that the employee’s hours of work would need to be significantly increased or decreased for them to become a permanent employee (for example to meet applicable award requirements).

- There are no reasonable grounds to refuse to offer permanent employment to the employee- If you answered No to one of the above questions you don’t have to offer casual to your employees, but if you said yes to question 1,2 and 3 you MUST tell them in writing and include the reason why. If you answered YES to all questions, you MUST offer your employee casual conversion.

- Notify your employee of your decision in writing.

- If you offer casual Conversion, the employee must respond within 21 days The employee must respond in writing within 21 days after the offer is given to them, stating whether they accept or decline the offer. If they accept, you need to meet with them If they decline your offer of casual conversion, you don’t need to meet with them. If they don’t respond to your offer within 21 days, you can assume they’ve declined the offer.

- If your employee accepts the offer, you must meet with them to discuss their new conditions of employment, including:

• whether they are converting to full-time or part-time employment

• their hours of work as a permanent employee

• their start date as a permanent employee.

You must then give them written notice of those details within 21 days of the employee accepting the offer to convert.

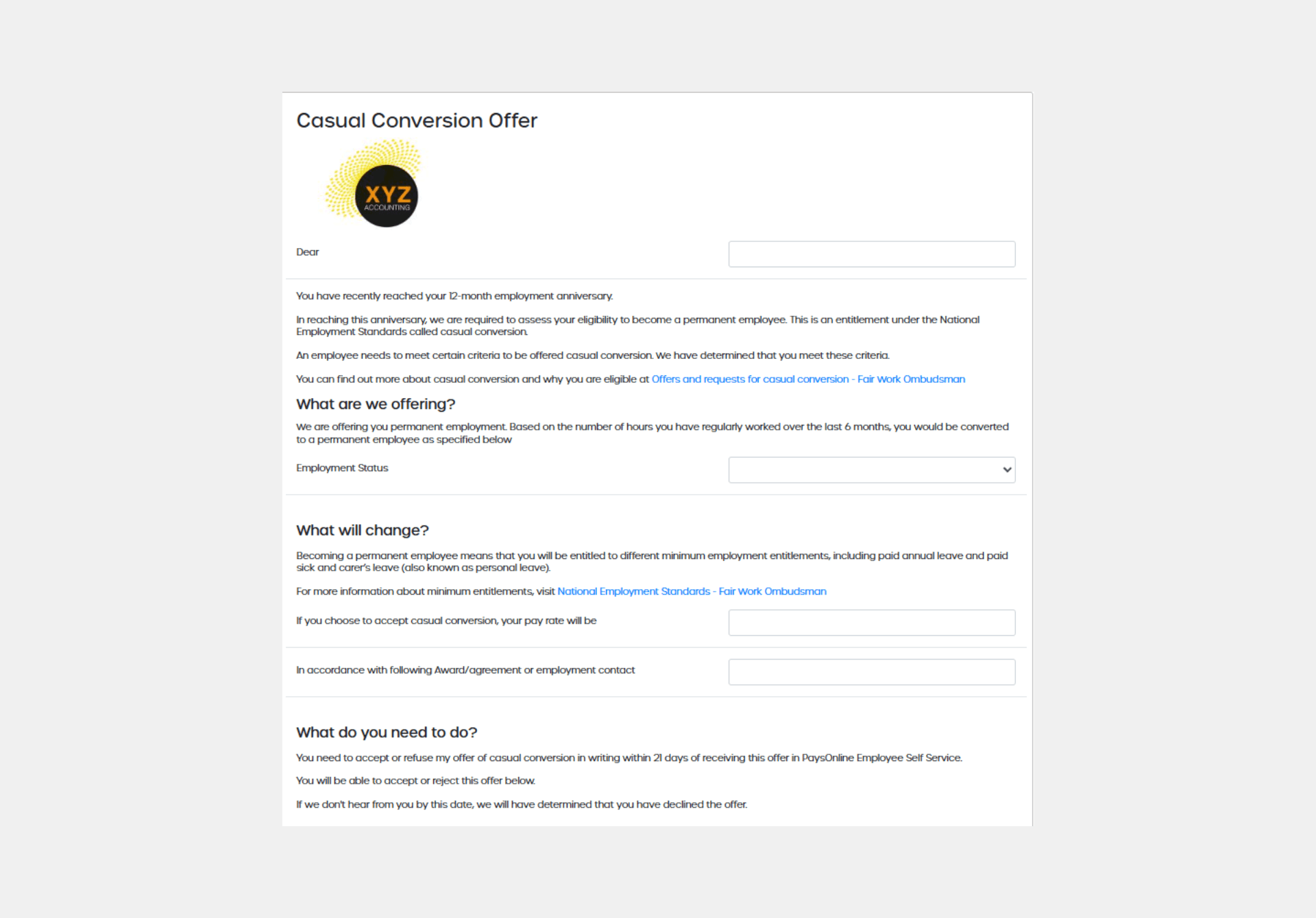

PaysOnline has created a HR SmartForm to assist with sending the Casual Conversion Offer to employees as well as a document for them to accept or decline the offer. This ensures that all data is recorded in one system for secure access.